A Bit of Unnecessary Panic - Assessing the Economy and Markets After the Reopening of the Government

Perhaps reopening the government wasn’t such a good idea. US equities rose during the record long Federal Government shutdown, right in line with historic experience. Since the reopening announcement, however, US equities have pulled back about 1.0%.

- Markets are worried that the Fed will ignore signs of weakening labor demand and skip a December rate cut. We believe private survey data and delayed government reports will convince them to keep cutting.

- But away from a slump in hiring and a brutal decline in consumer sentiment, demand data suggest a healthier economic picture will emerge.

- Autos sales, retail spending and home purchase applications were steady or rising throughout the shutdown. Weak manufacturing, trade and construction industries are poised to play “catch up” to satisfy demand in the coming year.

- This period merits adjustments to what’s in portfolios, but not a reduction in our equity allocation. In line with our past comments, we’ve increased our overweight to Healthcare and see a 15%-20% return for the sector in 2026.

After the Shutdown

With an executive signature, the longest US government shutdown in history ended after 43 days. For some Federal workers, the shutdown meant a delay in pay for a month. For US travelers, flight cancellations led to major disruptions across the US. With DC closed, large numbers of workers were temporarily furloughed. Consumer sentiment plunged.

If one believes the US economy is now vulnerable, a data blackout could potentially blindside investors and policymakers. Do any of these issues matter for the future?

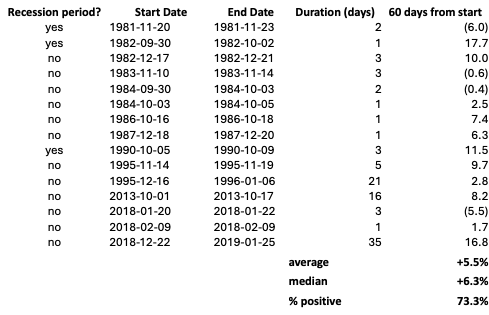

As we’ve discussed previously (see October 1 Linkedin post), there are no data showing a lasting disruption to the US economy during any prior government shutdown. US equities once again rallied during this year’s shutdown (Figure 1).

In the Absence of Data

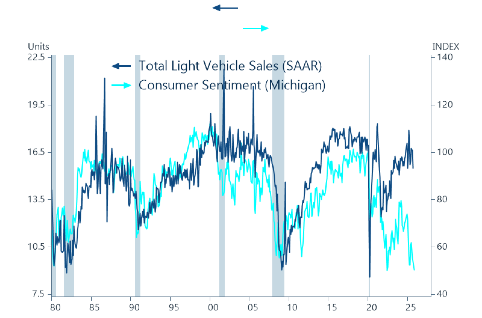

As the government data machine flicker’s back on, one can still imagine a “recession on the horizon” scenario. The best measure of consumer sentiment has fallen 32% to a level typical of a deep recession in the year-to-date (see Figure 2).

At the same time, US auto sales remained relatively steady at January’s level (15.5 million annualized) this past month. Beyond autos, weekly chain store sales showed accelerating growth throughout October. Home purchase applications also rose in recent weeks. This is inconsistent with the consumer sentiment data.

While a private survey highlighted a sharp rise in planned layoffs (153,000 in October 2025, +175% y/y), actual unemployment claims filings have not shown a dramatic rise. Notably, however, job openings data from recruitment firm Indeed Inc. shows slowing demand, a fact that Fed officials will have to acknowledge.

Forward-Looking Observations for Portfolios

Whatever fears US consumers have, it’s not causing them to close their wallets.

Useful financial activity, including car sales, mortgage applications and home sales, can be tracked without Federal help. Among the strongest messages from the data of the past month is a dichotomy between how American consumers feel and how they spend. But how they spend determines the direction of corporate profits.

Before the government data blackout, reports showed inflation-adjusted US consumer goods demand rising at a 4.2% year/year pace through August. Imports have been falling after a pre-tariff surge. Domestic production has been rising at a sub 1% pace.

Consumer sentiment fell much more than demand measures in the past month. Unless demand falls, US production and imports have to rise to satisfy demand in the coming year. This suggests that a rebound in both business and consumer confidence lies ahead.

Data on unit vehicle sales are considered among the very highest quality measures of the state of the US economy. The data are not statistical samples and extrapolation, but rather a hard count of every single auto and truck sale. The data don’t show an automotive boom, but maintenance of a consistent sales pace across 2025.

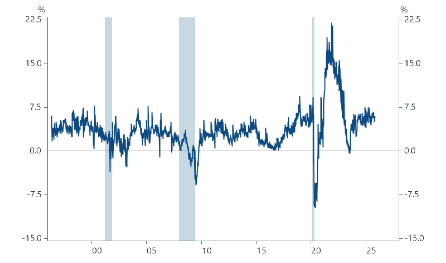

During the past month, mortgage applications for home purchases also rose and surveys of chain store sales accelerated (see Figure 3).

The Fed Will Gets the Message

The Fed’s interest rate policy is highly reactive to US unemployment, more than any other global central bank. But comments from Fed regional Fed policymakers caused market watchers to worry that the Fed will not cut rates soon enough to support the slowing jobs market. However, with inflation abating as tariffs normalize at today’s higher levels, the Fed’s employment mandate is likely to take precedence.

We believe the incoming data on labor demand will warrant a 6th rate cut next month and two additional easing steps by the end of 1H 2026. This would leave US policy rates at 3.0%-3.25%. As we have written, there is enough present and forthcoming employment data to encourage the Fed to continue to stay on its easing track.

But Investors May Miss It…

In our view, present conditions suggest that a broadening recovery is more likely to take hold in 2026. We are not arguing for a boom in cyclical industries, but rather the broadening of industrial growth beyond investment in data centers in 2026. Private survey data are consistent with this outlook. The Institute for Supply Management’s eight-decades of reliable purchasing managers data shows manufacturing inventories falling faster than orders. Production-related readings are consistent with 2% US economic growth while demand pointing to faster growth in the year to come.

As we discussed two weeks ago, hyperscalers such as Amazon and Meta are increasing their investment spending on datacenters at a rapid pace. Business investment in computing equipment grew +42% year/year in 2Q 2025. It might accelerate a bit further in the near term.

Lower rates will bolster hiring in some sectors like commercial and residential construction, with some recovery also in business services.

Changes to our Active Asset Allocation

More Healthcare

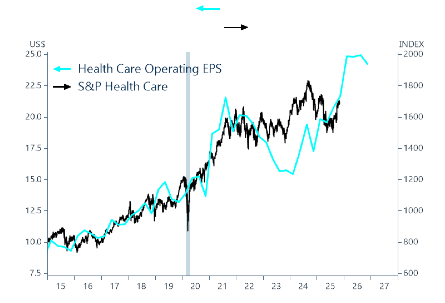

As we’ve written since September, the underperformance of the healthcare sector has been one of history’s largest, -30% versus the S&P 500 12-month return at this year’s low point. Additional pharmaceuticals tariffs are possible. Regulatory fears are an overhang on sentiment. Negotiations over the Federal budget will also not help health insurers (our least favorite healthcare group). With this said, healthcare shares are lagging behind actual profit gains and estimates for future gains (see figure 4).

The recent period of health care underperformance relative to poor-quality cyclical industries seems likely to change in the coming year. We could foresee a 15%-20% total return for the broad sector in 2026. As such, we are increasing our portfolio overweight of 1% to 2.5% for diversified investors and more for equity focused investors.

Smaller Allocations to Internet, Gold

As we’ve also written, gold is an asset with desirable properties given foreign diversification from US Treasuries and future rate cuts from the Fed. However, it’s outsized 60% gain over the past year suggest “momentum” investors have piled in. Gold won’t win in every scenario, particularly as its correlation with equities has risen. After large gains, we have reduced our exposure to a smaller overweight.

The correction to hyper-scaler AI/social media tech in the past month is also a volatility warning. We do not fear that AI investment will be ruinous for firms such as Meta and Alphabet. While optimistic on the future of tech, but we believe investors need to mind highly concentrated positions that add idiosyncratic risk. We are taking action to reduce such risk in client portfolios. Accordingly, we are reducing the scale of our overweight to these firms to fund the increased overweight in healthcare.

CIO Group’s New Overall Allocations

Markets have became more volatile as some participants worry that weak consumer confidence and softening labor demand presage a recession. We do not see that as the most likely scenario.

We see a combination of lower rates, broadening of investment in manufacturing, a modest increase in residential and commercial construction and sustained consumer spending powering an increase in US corporate earnings above +10% in 2026.

We are therefore maintaining a full equity allocation of 59.5% for moderate risk level portfolios (see Figure 5). However, within that allocation we have added to healthcare and reduced allocations to gold and communications services (tech related).