Boom / Bust Investing

Understanding the CIO Thinking Behind Our Active Asset Allocation

In this issue of The Point, we present our current thinking about markets and tech. We also discuss the CIO Group process of Active Asset Allocation, which is based on sector, geographic and asset diversification rather than stock selection. Our unique intersection of macroeconomic and market analysis are designed to monitor market data in real time, \ allow us to project and anticipate earnings and economic activity. When these and other factors are inconsistent or contradictory, we take portfolio actions – And so we explain what we might do in a “Bust” scenario herein.

The Inevitable, Not Yet

Everyone knows that economic booms are unsustainable, yet portfolios benefit greatly from boom times. The pace of AI-related business investment (72% over two years) is unsustainable. Investor skepticism is healthy. But we don’t see signs that excessive optimism has reached an imminent danger point.

A slowing in AI adoption rates is focused on existing applications, not forthcoming innovation. Concerns over debt growth by the largest, most profitable public firms also seems premature. The top 5 public hyper-scalers accounting for just 2.1% of US business debt.

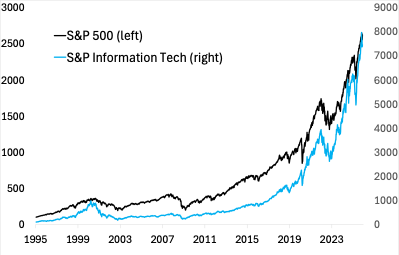

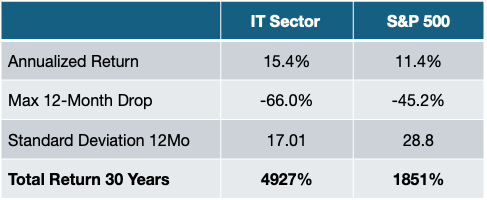

With all this said, disruptive innovation comes with greater market volatility. Over the past 20 years, semiconductors are the highest returning and most volatile sector within the broader market. And we know bear markets are inevitable, and areas of the most rapid growth typically contract most sharply.

Current Market Update

While Tech shares posted a setback in November, investors in 2025 had seen seven consecutive months of positive US equity returns on their way to a third positive year.

November’s market jitters felt much deeper that the -5.1% drop in the S&P 500 from late October 28 to November 20. For many, it had an ominous quality. Reports of a slowing pace of end-user AI adoption are rampant. Some of these are based on comparisons of user growth and time spent interacting with applications over just six months (see Figure 1).

In the present cycle of rampant AI growth, chip makers, LLM builders, data center developers, power generators, certain software sectors and manufacturers of any and all equipment elemental to the AI boom have seen major share price appreciation. Yet, after seven months of US equity gains, many investors still wonder if the AI-led boom in the economy and markets has reached a major peak.

AI’s first wave may have hit a crescendo, but there are several to follow. A second wave will be the development and rapid, prolific rollout of AI applications and agents.

What gives us pause now is the data. In short, it is “too good”. The AI spending boom is huge, but it cannot accelerate from here. Business investment on computer hardware rose 72% over the past two years. Some of the largest tech and telecom firms have just become 2025’s largest bond market borrowers. These are not repeatable events. Booms, by definition, are never sustained indefinitely.

When A Semiconductor Stock Leads the Market…

Nvidia’s share of equity markets in 2025 is the largest single-stock concentration since 1980. After hitting a recent peak in late October, Nvdia is still 7.1% of the S&P 500 and 6.0% of the Wilshire 5000. No single stock in modern times has had a higher share (please see our last bulletin for discussion).

Over the past 20 years, semiconductors are the highest returning and most volatile sector within the broader market. While innovation in the sector certainly pays off over the long term, the sector’s drawdowns can be brutal. The reasons are structural. Revenues and margins can swing widely on product cycles, leading to sharp contractions 12-18 months from peak. The sector is also very sensitive to macroeconomic slowdowns and shifts in sentiment. This means that semis can lead the market up and down – their market beta is 1.7x.

Not At Peak, But Near Peak

Pauses and shifts in spending patterns in a competitive, disruptive tech landscape are to be expected. Investors might reasonably fear that corporate AI spending is a cost of staying competitive, rather than expanding future profits overall. And the depth of adoption of AI will take more time than expected, even though its value in simple use cases is extremely high.

We are doubtful that this is the “peak moment” of the AI spending boom. There’s been nothing in the recent tech profit data or guidance on coming quarters to disappoint us or alter our investment views beyond our most recent active asset allocation shifts (see Figure 2).

Business debt growth is modest relative to the IT spending boom of the late 1990s. Despite large bond offerings for firms from Oracle to Meta to Microsoft, the overall scope of borrowing has not reached boom-time growth rates for related sectors (Figure 3).

Questions We Consider Before a Bust

While we think a bust is not upon us, we consider a few questions along the way.

- How might be able to assess a peak before markets fully price in a future decline? Being late makes defensive actions useless for returns.

- What sort of portfolio changes can we make for a period of “defense” if one can truly get ahead of the market?

- And what are the portfolio consequences of getting the view and actions wrong? Changes are far easier to make than getting the timing to benefit portfolios right.

Market Timing Is Not the Answer

Having invested through two 50% drops in US equities including consecutive calendar years of decline in the late 1990s and during the GFC, we have learned that there is no one early warning sign that tells you when a bust has begun.

For ages, investors have attempted to generate simple rules to follow to attempt to know when they should be invested and when not to be invested. This “market timing” approach has been one of the most damaging to long term returns. Missing the best days in the market is one sure way of destroying portfolio value.

For example, consider the US Treasury yield curve, the single best long-term leading indicator of a US recession. Since 1960, US equities have delivered a positive return in 71% of all quarters. In periods of an inverted yield curve – a potent early warning – US equities delivered a positive return 63% of the time. While Treasury market dynamics are useful for risk management, they are far from a silver bullet for market timers.

While we agree that wise investors should be “fearful when others are greedy”, those doing so via options need to monetized gain quickly as options premia values change more quickly than underlying asset prices.

Need for a Wholistic View

CIO Group’s practice of tactical active asset allocation is focused on risk management and building portfolio results for unexpected events.

Part of risk management is the art of gathering information on a continuous basis while seeking data based on hypotheses honed by years of investing experience. Here are two examples. Excessive borrowing could be a sign of irrational exuberance and put major companies at risk. Yet, as 2005 unfolded we saw that the top 5 hyper-scalers in public markets borrowed at 14% pace in the past year. This was merely in line with the revenue growth. So, that’s not a red flag.

A future concern is a downturn in data center construction in 2027 with knock-on effects in manufacturing, energy and associated services. We will monitor the pace of that construction and order books to assess the risk of an earnings stall or decline for those firms.

We believe the time will come in 2026 to take steps to diversify more strongly away from technology equities, but not away from equity markets. The Fed can’t “engineer” a perfect economy, particularly over the longer-term. For now, we believe our portfolio positioning is best able to take advantage of rapid EPS gains still ahead in the first half of 2026.

Active Asset Allocation Works, Active Stock Picking Not So Much

The fact that NVidia is 7+% of US markets is an obvious concern. If you asked most advisors entering the market with fresh capital if starting with such a high weighting to one stock was wise, most would say no. It is therefore possible to change one’s exposure to the tech sector by using direct indexation to modify share weightings or by focusing on certain sub-sectors of the tech market over others. Selecting software or cybersecurity shares whose revenue streams are more diversified and whose earnings are less volatile, we can mitigate the concentration risk inherent in semiconductor shares.

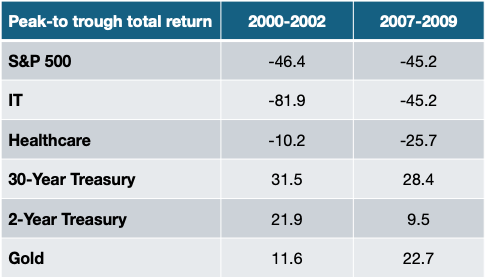

That said, we will not ignore the inherent value of technology as a driver for US industry and US markets. Including the drawdowns of 2000-2002 and 2022, innovation is persistent in creating wealth for investors. The data in Figure 4 should dissuade investors from thinking that one should wholly disengage from tech investing that drives economic development (please see our Outlook 2026 for more discussion).

When the Contraction Comes, CIO Group Is Ready

The present level of optimism in financial markets is reflected in higher valuation metrics. Overbuilding in the economy is decidedly different. This is why CIO Group uses its knowledge of both the economy and financial markets to inform our risk management.

If we had high conviction that a moderate to severe corporate profits contraction was coming and markets had not moved sufficiently in anticipation of it, we would be inclined to push long-term US Treasuries to our largest single portfolio weighting. Foreign high-quality bonds would move up from our current underweight. Our overweight in healthcare sector shares would be even larger. Over time, we would add to our gold weighting as the Fed easing. As Figure 5 shows, the longest-duration Treasury returns have been the strongest and most consistent in non-inflationary crisis periods.

Our present portfolio does not anticipate such a downturn at this time. Nor does our monitoring of the economy and markets. Yet, being prepared is always wise.