Preparing Portfolios for 2026

Using a Break of “Momentum” to Your Advantage

Markets are exaggerating positives and negatives, with traders looking for excuses to liquidate assets when “bad news” appears at a moment’s notice. At the same time, as CIO Group has illustrated in its Outlook 2026, we are in a period of fundamental economic change with the rapid advancement of AI and shifts in geopolitics underway.

We believe this moment presents several opportunities to create much stronger and more resilient portfolios than many family office and wealth owners now have. One needs to create portfolios that can be held through episodes of mispricing and fundamental change. Deviations from fundamentals create opportunity. And when looking ahead, we can identify areas of future value when price breaks occur.

Invest Long Term, Allocation Where Earnings Growth is Accelerating

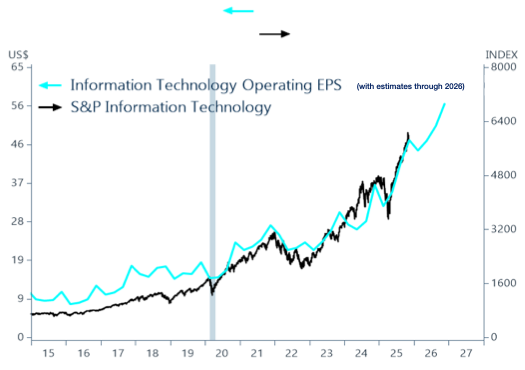

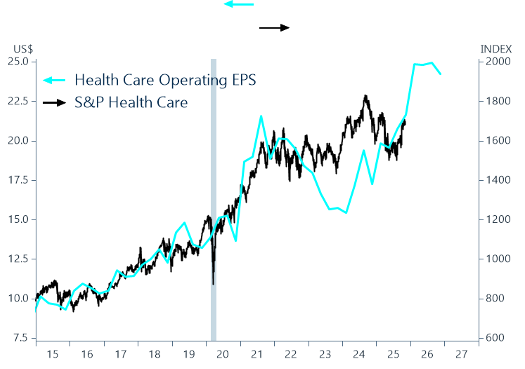

Despite increased government intervention and an erosion of free market forces over the past two decades, asset prices have still largely done their job predicting future fundamentals. This is more true of equity markets than bonds, where central banks exercise greater influence. Key sectors of the US equity market have risen and fallen ahead of actual profits (see Figures 1 and 2.) Quite simply, investors in US equities – who’ve enjoyed a 7% return in excess of inflation over the past century - buy future business profits, not past results.

In the short term, equity markets are far less predictive. Markets recoiled in fear in early April confronting the imposition of the largest corporate tax increase in history in the form of tariffs. They initially exaggerated the future impact on the economy’s performance. They also exaggerated to $750 billion scope of tariff increases to come. Shortly thereafter, US and global equities staged an historically fast “upward correction.” Actual tariff increases annualizing just $275 billion over past six months with the Supreme Court now sternly questioning their legal basis.

How to Prepare a CIO Group Forward-Looking Portfolio

We believe in allocating to the fundamental drivers of returns: growing profits in equities, reliable yield in credit and under-priced stores of value. We take a strong view on the direction of future fundamentals to drive our over- and underweight allocations. Of course, forecasts can be wrong and fundamentals evolve away from expectations. Diversification means that portfolios will underperform high flying parts of the market, but it also adds to one’s returns when momentum breaks.

The CIO Group asset allocation model balances these factors with an intense focus on seeking sustainable growth within equities and most durable values in fixed income. This is a more specific approach than typical asset manager portfolios. We use specific market exposures where we expect earnings to grow meaningfully over years to come. We also choose specific undervalued parts of the market for inclusion. And we avoid sectors that add only to volatility rather than sustained growth (airlines and autos are examples. Please see our Outlook 2026 for a deeper description of our Active Asset Allocation Process.)

What the End of Earnings Season Tells Us

IT-related shares zoomed ahead of recent earnings results in a prediction of the future. This included components of the Telecom and Consumer Discretionary sectors, too. (Shares of Alphabet and Meta are included next to AT&T in Telecom, just as Amazon sits next to McDonalds in Discretionary). The reports included increased investment by the large tech-related firms in AI, indicating sustained demand for high powered chips from Nvidia, Micron and AMD.

3Q EPS reports for the tech and telecom sectors beat expectations by 5% and 11%, respectively, with the largest firms reporting double-digit growth in absolute terms. When large firms are reporting major revenue and profit beats, it underscored growing demand for their services and AI applications. The 3Q “beats” were large enough to push up full year EPS expectations for 2025 and 2026 in most cases. However, the market cap of the combined sectors jumped by 4.9% in October, a 59% annualized pace of appreciation that is rarely sustained without some pullback.

While short-term traders looking to book profits, it’s worthwhile for investors to assess if a correction would dissuade one from staying invested, and at what level. In our view, the tech-related sectors are still likely to produce double-digit profit gains again in 2026. That may or may not be true for 2027. Our portfolio overweights in US tech-related sectors or roughly 6.5% are therefore large enough for 2026 and will be revisited periodically.

Conversely, the Healthcare Sector is not strongly beating EPS expectations in 3Q, with a gain a little more than 1 percent above forecasts thus far. Absolute results are weighed down sharply by health services and equipment. The largest component, pharmaceuticals, saw EPS grow 9% from a year ago, while share prices are up just 2% over the same period.

CIO Group is therefore investing in a healthcare recovery and would consider raising our allocation further even if share prices fell in the near term. EPS Expectations for pharma and broader US healthcare show gains near 10% for both 2026 and 2027. Given fundamental demand growth and key regulatory and tariff uncertainties holding down valuation, these EPS expectations have room to grow.

All That Glitters…

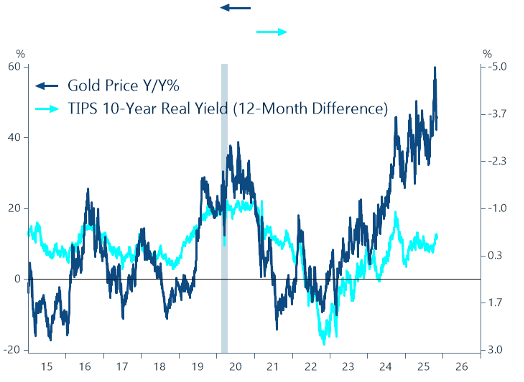

Gold’s 2025 rally has been driven by a re-allocation of foreign reserves from US dollars to the metal. Various actions to sanction or confiscate foreign assets has diminished trust in US Treasuries as an official reserve asset. China added more than 10 million ounces of gold to reserves in the year through early 2024 before slowing down purchases. Yet as prices rose, other investors bought into the upward momentum.

Buyers on “momentum” will tend to increase gold purchases as prices rise. Gold users will buy less as it becomes less affordable. But fundamentals that would drive the gold price higher – lower US interest rates and a weaker US exchange rate -- still look appealing. This is why we are maintaining just a small gold position even as the price overshot in our view (see figure 3).

The Present Bitcoin Fade Presents an Entry Point

The recent decline of Bitcoin, including trades this week below $100K, have caused some investors to question its long-term investment potential. We are seeing some major, long term holders sell Bitcoin, some to diversify and others to buy other cryptocurrencies. This seems likely to continue for 3-6 more months. A liquidation in leveraged positions in early October has been followed by the sale of about $45 billion Bitcoin from “whales” (large holders for many years).

While investors may view the sales as a warning, we take an alternative future-forward view. We see this as a transition period for Bitcoin, from speculative to a more institutionalized asset. Bitcoin ETFs, equities that function as Bitcoin treasuries and the increased acceptance of Bitcoin on corporate and sovereign nation balance sheets are substantive changes in who owns Bitcoin. Passage of the Genuis Act and an accelerating increase in the use of Stablecoins (digital dollars) also speak to the institutionalization of digital assets, including Bitcoin.

When Bitcoin was wildly speculative, its ownership was highly concentrated. Its price moved violently because of the unstable ownership base and the use of leverage. Now, as the asset has increased in value and its ownership broadens mightily, the market is more stable.

After an IPO, we see exactly this type of behavior. Large holders migrate to indices, ETFs, institutional portfolios and retail investors. The maturation of Bitcoin means it will not be as exciting, but it will be more useful in portfolios. As Bitcoin ascension to institutional status is completed, it will more from a purely speculative asset to a store of value over time. Gold will have company. For investors, this is a good thing.

For more information see this article