Is the Stock Market Worried About the Right Risks?

Addressing a $5 Trillion Question

As we end a volatile week in the US equity markets, we see two distinct narratives unfolding. The first narrative is this: Will the Fed Save Us? Consumer confidence is poor, consumer spending is moderate, but employment growth is slowing further. The market-implied odds of a rate cut in December vacillated sharply over the course of the week from as low as 30% to 65% as of Friday. The second narrative is this: Can the AI Boom Go On? NVDIA’s extraordinary performance of revenue and cash flow growth was on full display Wednesday. But by Thursday morning, nervous sellers drove NVDIA stock back to its pre-earnings call levels.

We remind readers that our Outlook 2026 calls for a 10% rise in corporate earnings and sustainable high growth rates for technology spending.

So, what do we make of this week?

- Equities investors wonder if AI-related capital investment spending is sustainable. We believe the spending boom has legs through 2026, but its growth rate of 40% is not sustainable.

- Advances in semiconductor technology and applications have transformed human life. Commercializing this technology has driven powerful returns for related equities. Yet, semiconductors are an inherently cyclical industry, one that saw declines in revenue and earnings as recently as 2022.

- Unlike hyper-scalers such as Meta, Google and Amazon, US semiconductor firms have become less capital intensive, outsourcing production to Taiwan. This has allowed profit margins to rise faster than ever before.

- At the same time, semis have never been more central to US and global equity market performance with a 14% share of S&P 500 market cap.

Our conclusion is simple: US tech stocks require more intensive risk management. For investors with high concentrations, we see opportunities to mitigate risk while maintain core exposures.

How NVDIA Ate Intel’s Lunch

At an event earlier this year, we had a chance listen to Nvidia CEO Jensen Huang discuss the history and future of the semiconductor industry. The tale he tells is not widely understood, but his words are mirrored in the rise and fall of his competitors over the past twenty-six years.

As Jensen explains, Intel dominated semiconductors globally for decades with its general purpose processors (CPUs). Roughly doubling the number of transistors it could fit on a sliver of silicon every two years (so called “Moore’s law), But in the mid 2010s, Intel began running into atomic-scale physical limits as it moved toward 10 nanometer processors. Various parts of these electric brains would sit just 12 atoms apart.

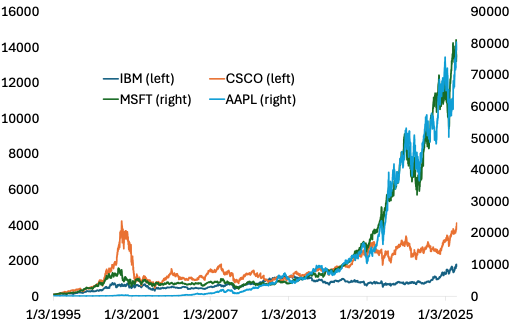

For almost 20 years, Nvdia trailed Intel. Nvidia’s special purpose chips appeared unnecessary, as Intel’s ever faster processors could handle the same tasks. But by the mid-2010s, Nvidia began shifting chip designs toward three dimensional stacks, capable of addressing much more complex applications. Just 10 years later, Nvidia has eclipsed Intel providing the majority of chips for data centers powering the most advanced AI (see figure 1).

We Have Seen This Film Before

Digital photography has largely replaced physical film. Eastman Kodak was a top 10 market cap in the S&P 500 in. the 1990s, but was bankrupt by 2013.

Most of the top 10 market caps of the late 1990s have seen better days (Figures 1 and 2). Only Microsoft is a top-10 player across both periods. Of today’s largest firms, Apple’s resurgence is the only example of a company recovering from missteps to regain dominance.

We knew many investors who held excessively large stakes in Intel and Cisco systems far too long in the 2000s. We want to ensure that today’s investor don’t repeat that type of mistake.

The Big Drivers of Returns Can Lead to High Levels of Risk

As we discussed in our Outlook, technological breakthroughs drive per-capita economic growth. Successfully commercializing technology is the single-most important driver of equity returns. Long-term investors benefitted from exposure to these disrupters and change makers. That’s why share prices of firms such as Apple, Amazon, Tesla or Palantir don’t “make sense” using conventional market metrics in times when such firms have breakthroughs that change their industry. This is true even across tech bear markets like 2000-2002, when the Nasdaq fell 78%.

Where Hyper-Risks Are Building

Capital intensity in tech has shifted to the data center builders (“Hyper-scalers”). The largest tech and telecom companies have grown capital expenditures faster than cash flow. This has sent Meta, Alphabet and Amazon to the bond market to fund growth. Given their diverse revenue streams, we do not see their solvency at risk. Nor do we see the end of the data center boom at hand.

Nvidia’s value is largely in the genius of its chip designs and its business model. While its investment spending is growing rapidly or late, Nvidia does not have to spend heavily to raise its capacity. Its manufacturing is largely outsourced to Taiwan Semiconductor Manufacturing Company (TSMC). Yet, with Nvidia’s market cap piercing $5 trillion or nearly 8% of the US equity market cap at its recent peak, investors need to carefully manage this position.

The End of the Big Spend

Today’s growth rate in capital spending is unsustainable. Private investment flows to build AI businesses, including data centers, will certainly rise meaningfully in 2026. But sooner than later, fewer chips will be needed and semiconductor sales will fall. Quite simply, no significant part of the economy can outgrow GDP by 10 fold for many years.

Risk Management for Periods of Revolutionary Change

The top 7 US tech firms represent 22.2% of all global equities, a record high. Accordingly, investing in the technologies that drive transformational change requires risk management. Here are some methods to consider. (Call us for more details on strategies and implementation.)

Start with Diversification

Risk taking in high growth sectors requires building diversified portfolios to buffer volatility. Last week, we highlighted area of the market that do just that. Healthcare technology is under-valued in markets relative to AI themes. Components of world credit markets are cheaply priced relative to equities. Non-US assets are historically cheap.

As we noted last week, we expect US healthcare shares to return 15%-20% in the coming year. Our expectation for the safer bond component of portfolios is near 5% in 2026.

Take Control Over Portfolio Exposures Using Direct Indexing and Hedges

We do not suggest investors ignore market benchmarks and construct idiosyncratic portfolios. Yet with Direct Indexing – owning the individual shares within the market benchmark - one could take hedge a portion of one’s exposure to the largest tech firms.

Consider Single Stock Risk Management

For investors with concentrated single stock risk – such as those who have a position in a firm they founded or their employer’s shares – long holding periods generally mean large unrealized capital gains. Hedging may help reduce volatility and downside risk for such shares.

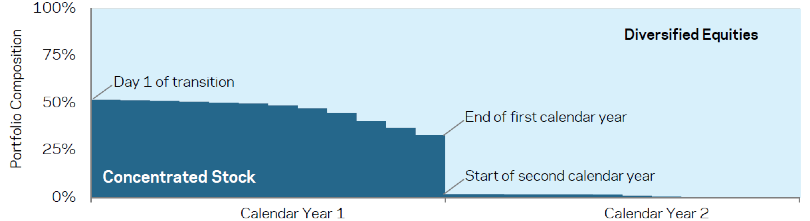

But if an investor wants to lower their stake in such a position, it is possible to construct an overlay to portfolios that harvests short-term losses, offsetting taxable gains while the investor reduces concentration. At CIO Group, we have several partners who work with us to mitigate taxes for our clients selling down concentrated positions. A hypothetical illustration is shown in figure 4.

Investors are now gripped with fear that they are investing at the peak of a bubble in the economy. The growth rate of AI-related spending is certainly unsustainable at the present pace. This doesn’t mean that most investors will know when a peak is in or how long and deep future setbacks will be. Yet very high levels of portfolio concentration does represent a bubble of sorts. There are strategies at hand to address these risks well in advance of negative outcomes for portfolios.