The Fed Is Not There for Investors: Timely Strategies for the Likely End of Fed Cuts in 2026

- After delivering a 6th rate cut since late 2024, FOMC participants pushed up their forecast for US real GDP growth in 2026 from +1.8% to +2.3% and pushed down their expected inflation rate from 2.6% to 2.4%. Global growth is likely to benefit as well. These more optimistic estimates are now much closer to our own.

- We see just two more rate cuts ahead in 2026.

- The Fed’s actions are unusual given that it is reducing rates significantly when the economy is growing. The AI boom in spending is counteracting the impact of erratic US tariff policies and their negative impact on manufacturing and trade.

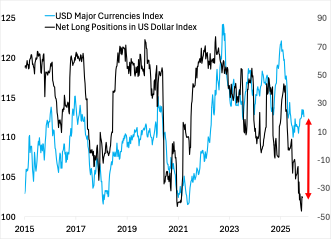

- Record short positions suggest the chance of a counter-trend rebound in the US dollar. However, it is still likely to weaken further over the longer run with its inflation-adjusted value still 14% above historic average. This makes selective non-US equity and bond investments attractive.

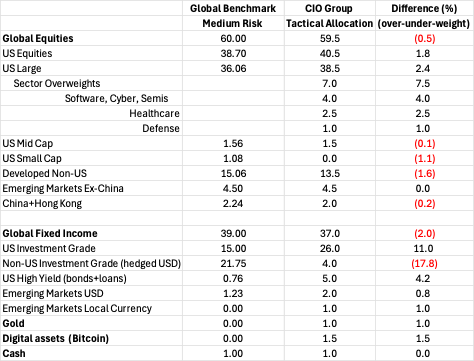

- With this said, we are adding to defensive positions in healthcare and maintaining a significant weighting to intermediate bonds.

- Changes in leadership are slow at the Fed and the voting structure works to limit political interference. With that said, the next several months could see heighted speculation that the next Fed Chair will act to ease more aggressively – even inappropriately.

Fed Friend or Foe?

For many savers and investors, it feels like the Fed is in the business of making life harder. Bond prices drop when the Fed pushes up policy rates. Future yields decline when the Fed pushes rates lower. The Fed is responsible to US public for delivering both “price stability” and “maximum employment.” It is also significantly charged with protecting the US economy, banking system, and confidence more generally.

To bear such responsibilities is made far more difficult by circumstances. From the banking crisis of ’08, the pandemic of 2020, to the scattershot imposition of tariffs globally in 2025, the Fed has limited tools. These include rate setting, liquidity provision to banks and the interpretation and communication of what it sees in the data. Its voting system and dissemination of information are the tea leaves we read to understand its thinking and actions. Yet, the Fed is reliant on macroeconomic and financial stability to achieve its price and employment goals, neither of which are solely under its control.

The Value of a Dollar and the Value of Non-US Investments

The period of high real US rates and other positive factors pushed the US dollar toward its second highest level in history as of December 2024. In 2025, dollar financing costs have come down. For the rest of the world, the Fed’s further easing is a “weight off their backs.”

In the pandemic shock, the Fed both eased and tightened monetary policy with historically aggressive actions. Other central banks were forced to follow, but in many respects did not act as aggressively in either direction. This now leaves the Fed reducing short-term interest rates downward towards the global average.

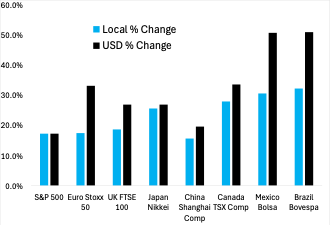

if the US economy gathers strength next year as CIO Group expects, the Fed’s current rate cutting cycle will have limits -- we expect just two more cuts. For US investors, selected international equities and bond markets will poised for another year of solid gains in 2026 (see figure 1). This is likely even if the US dollar doesn’t retrench sharply once again. Heavy shorting of the US dollar is unlikely to profit as much as it did in 2025 when US tariffs shocked the world (see figure 2).

No Emergency to Fix

For the US and the world, the good news is the Fed’s easing steps are not taking place as a result of an economic collapse - quite the opposite. As we have written before, economic growth in 2026 is expected to accelerate some and broaden in scope (See our Outlook 2026). In short, the Fed’s forecast confirms our previously published views. The median forecast of FOMC participants pushed the 2026 expected real GDP growth rate for the US from +1.8% to +2.3% (Figure 3). Simultaneously, committee members pushed down their expected inflation rate from 2.6% to 2.4%.

Weak US imports, domestic manufacturing and the housing sector dragged on US growth in 2025. A reversal of these negatives should boost global growth next year. As a consequence, we will consider enhancing and broadening non-US investment allocations in coming months.

Assuming CIO Group and the Fed are right, we expect just two more 25 basis point cuts in 2026 after 6 in 2024-2005. A Trump-appointed Fed Chair in May might sway the Federal Open Market Committee somewhat toward larger easing steps. However, the many FOMC voting dissents and the slow process of change in committee personnel suggests modest risk that Trump’s new appointments will take US monetary policy off course.

A new, more “dovish Fed Chair” is already supporting positions that benefit from a decline in the US dollar. The renewed strength in gold, silver and belatedly bitcoin after price corrections suggests this is the case.

Warning: This Fed Easing is Unusual

What makes this moment unusual is the fact that the Fed is lowering rate to normalize a post-pandemic economy at a time when an AI boom is underway. We have previously written that the AI boom in chip purchases and data center construction is unsustainable. We have also written that for 2026, we see earnings growth in the US broadening and no imminent collapse in AI-related spending.

When we see the deceleration in AI spending, the Fed will have other challenges that will depend on how the rest of the US economy performs. If there is greater employment weakness or a larger ripple effect of the AI slowdown on the general economy, the Fed may be forced to act again. If shocks again surface, a recessionary scenario could unfold.

Our Portfolio Positioning

With yields solid and equities deep in a bull market, we maintain a balance between “offense and defense” in equities and fixed income. Our bond allocations have strongly favored US markets and USD assets (see figure 3). If US yields moderate further, we may increase foreign allocations, likely with greater local emerging markets exposure for a small portion of fixed income assets. Sharp rebounds in the US dollar are common after short positions build, and such an event may be an opportune time to add further to EM.

Our US tech-related position in equities remains overweight but has already been reduced some. Given expectations for strong EPS gains in related sectors in 2026, the lack of appreciation of tech shares in some international markets may suggest enhancing our positioning. We already invest the bulk of our allocation to emerging markets equities in Asia tech. We believe AI will eventually be a more investable “off shore” option.

While we strongly believe US economic growth will broaden in areas like housing and consumer goods trade, the solid performance of many industrial/cyclical companies suggests this is mostly priced in. “Defensive growth” still seems best valued in healthcare, where we added a larger overweight last month.

Conclusion – Some Calm to Come Before Storm?

The next Fed Chair might have most of the Fed’s rate cutting work out of the way by the time he or she takes the post in May 2026. If the US economy is firming and inflation is quiescent for a time, it might momentarily feel like an “easy job.” Yet as we discussed in bulletins of the last two weeks Dec 7 & Nov 22 - managing a period of investor euphoria over technological change, challenges to employment and inflation simultaneously will in time prove challenging for both investors and the Fed.