For Investors, It All Adds Up to Higher Profits in 2026

AI is going to drive higher productivity in 2026 and beyond. That means more profit per unit of labor.

CIO Group also expects that Fed rate cuts will help arrest further weakness in the labor markets.

These forces suggest that profit growth will continue to outpace labor market gains in 2026.

As discussed in our Outlook 2026, this “new” combination (higher productivity, lower rates and less policy uncertainty) fuels our still bullish outlook on growth sectors of the world equity market in 2026 (see Figure 5).

Importantly, this environment calls for a full allocation to fixed income. Bonds are now fairly valued, meaning that they earn a higher interest rate than expected inflation and can provide meaningful diversification to investor portfolios.

Finally, an AI frenzy (i.e. high prices for unprofitable AI companies), Fed easing and the FOMO of investors in a bull market suggest that markets may run too far, too fast if our base case proves right. We will be watching for any signs of excessive exuberance. So should you.

UNPRECEDENTED TIMES, EXCEPTIONAL PORTFOLIOS

CIO Group believes recent regional bank selloffs overreact to isolated credit losses—not a systemic collapse. Our Outlook 2026 sees potential for earnings growth ahead. We explore why quality, diversification, and forward-looking positioning matter now more than chasing past performance.

Fed Guarded on the Outlook for Employment

Stall Speed for Hiring

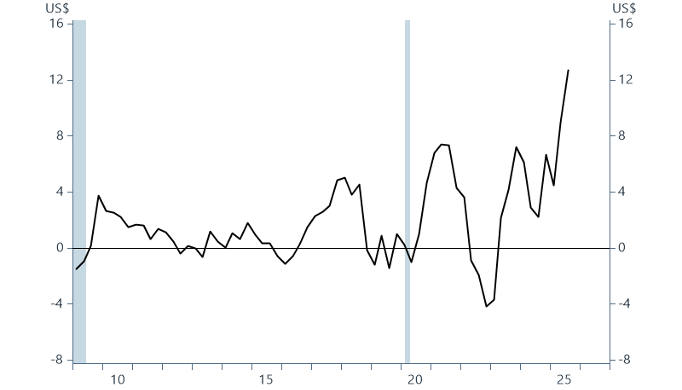

Markets Higher in 2026: At the Intersection of Tariffs, AI and Manufacturing

Contact the team at The CIO Group