Fed Guarded on the Outlook for Employment

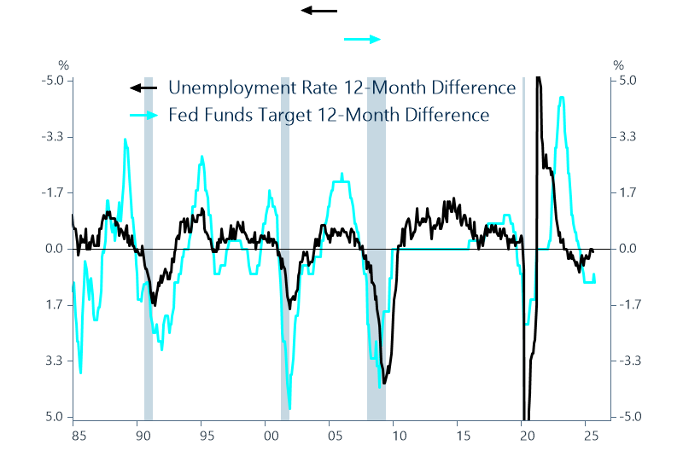

In the short run, Fed policy is driven by the US labor market more than inflation. The data (Figure 1) illustrates that changes in the US unemployment rate and changes in Fed policy rates are generally in lock step. After moving a bit out of sync around the pandemic, this relationship is normalizing.

We do not see a rapid collapse in employment. Neither does Chairman Powell. At the same time, the Fed is guarded because labor markets often weaken quickly once a slowdown is entrenched. At the moment, the unemployment rate is rising modestly, suggesting the Fed cut further over time.

Stall Speed for Hiring

Fed policy tracks labor markets more than inflation—their lockstep relationship is normalizing post-pandemic. With no employment collapse ahead and natural labor market weakening underway, Chairman Powell signals further cuts. Our Outlook 2026 explores why this normalization creates opportunity beyond reactive positioning.

Markets Higher in 2026: At the Intersection of Tariffs, AI and Manufacturing

Outlook 2026: Position Portfolios for Broader US Growth Ahead

For Investors, It All Adds Up to Higher Profits in 2026

Contact the team at The CIO Group