Outlook 2026: Position Portfolios for Broader US Growth Ahead

CIO Group’s Outlook 2026 anticipates some broadening out of the current economic expansion in the coming year. Why?

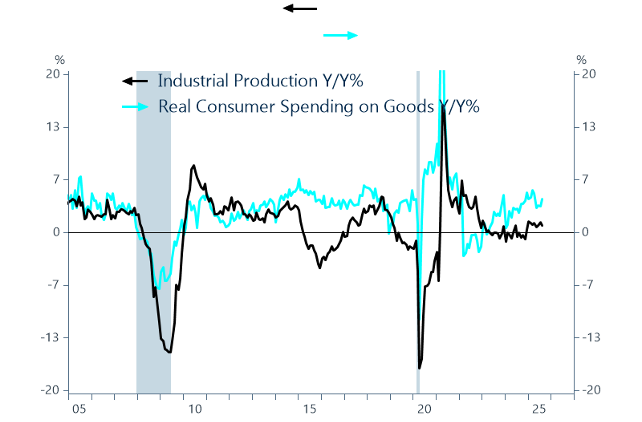

US Industrial production has grown just 0.9% over the last 12 months. In contrast, real consumer goods demand grew 4.2% (see figure 3). In the latest US Purchasing Managers Report, 9 of 10 domestic manufacturing industries reported tariffs and related supply uncertainty as a notable drag on their business. This explains why manufacturers have deliberately constrained their output over the past year.

With less trade uncertainty – in Asia, President Trump is rolling back tariff threats in exchange for more Direct Foreign Investment – we expect faster output growth in 2026.

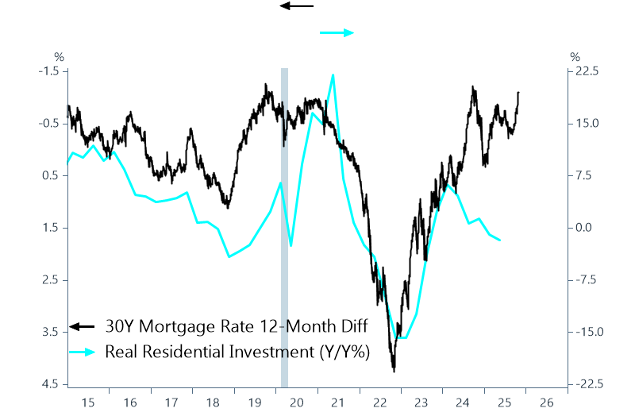

At the same time, we see economic benefits from further rate cuts. Lower rates and higher bank profits suggest greater credit availability (Figure 4). With lower mortgage rates and more capital available (see last week's episode), we expect a positive swing in residential construction spending, which fell in 2025.

None of this suggest a boom ahead. It does, however, suggest that the “K” in the economy – a marked division between rising and falling industries - will be less pronounced.

UNPRECEDENTED TIMES, EXCEPTIONAL PORTFOLIOS

CIO Group believes recent regional bank selloffs overreact to isolated credit losses—not a systemic collapse. Our Outlook 2026 sees potential for earnings growth ahead. We explore why quality, diversification, and forward-looking positioning matter now more than chasing past performance.

Fed Guarded on the Outlook for Employment

Markets Higher in 2026: At the Intersection of Tariffs, AI and Manufacturing

For Investors, It All Adds Up to Higher Profits in 2026

Contact the team at The CIO Group