Alts, VC & Digital Assets

Alternative Assets

Among other key questions for investors is the value of diversifying outside of public markets. There are many issues to consider. Returns for private equity have trailed public equity in the past decade and investors were forced to accept this return without the liquidity to alter their positions. In addition, we see evidence that some private equity managers are looking to retail investors to make their underwater positions whole, mis-pricing assets in a way that’s harmful for new investors.

On the positive side, the true cheapening of private assets should help future returns. Just as the 14% compounded return of the S&P 500 is likely to mean revert in the coming decade, so will cheapen private market assets if purchased at their true value.

Future credit risks have increased. Even so, a Fed induced jump in the cost of debt capital and solid lending standards is generating attractive future returns for private credit funds. This high debt cost is also among the reasons why smaller firms have fallen toward history’s lowest valuation vs large firms (see figure 11).

While not likely to change quickly, the decade ahead should be a better return opportunity for firms beyond the Magnificent 7. One needs to remember that the opportunities for AI and other innovations among private companies appears at least as large an opportunity as those of public firms (see figure 12).

We believe the larger effects of the US tariffs, immigration restraints and international discord will play out within 2025, leaving just moderate constraint on 2026 as a whole. Tariffs do not need to be pulled lower for their negative effects to fade. With global macro policies turning modestly more growth friendly - including a resumption of Federal Reserve easing steps - we see a strengthening upward bias in the economic growth trajectory for 2026. This is driving strong global equity returns this year, with a positive carry over likely deep into the coming year.

US markets are one beneficiary. China, Europe and their trading partners are others. It will not be enough to banish growth fears and market volatility. Global growth is unlikely to rise sharply above trend until 2027 at minimum. Inflation should continue to fade following a ‘’tariff bump,” but with questions of whether the drop will be lasting or sufficient.

A generational shift is underway. Senior GPs have concentrated carry, and equal partnerships are rare. This has led many next-generation investors, often the ones sourcing the most valuable new deals, to spin out and build firms where they can capture the value they create. However, given the difficult fundraising environment and operational complexity of running a fund, we anticipate many of the best investors will seek alternative opportunities that give them autonomy and more economics. These emerging investors are the likeliest candidates for the Midas List of the 2030s, and we are convinced by their differentiated access and work ethic.

Venture Capital

Venture capital remains a powerful complement to steadier assets: it buys exposure to frontier technology and power-law outcomes. But after the 2020-2021 valuation frenzy and today’s AI euphoria, discipline in both fund and company selection is non-negotiable.

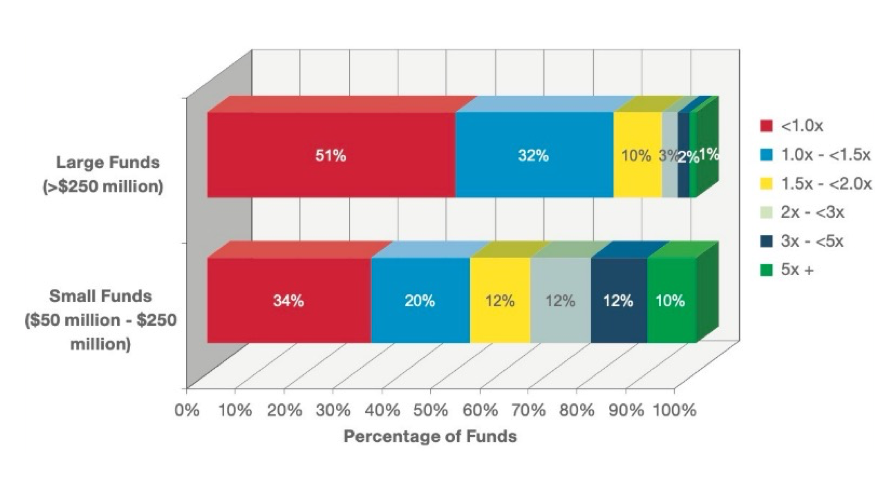

The best risk-adjusted returns come from early-stage venture. Sub-$250m funds, and especially first and second funds, consistently outperform legacy franchises, with small funds roughly 7x more likely to deliver 3x or better net returns. This is where to double down. Exposure to well-known, multi-stage brands looks more like diversified private equity; these multi-stage funds can be valuable additions to a private-markets portfolio, but should be underwritten in a different bucket than early-stage VC.

Alongside these trends, AI is rewiring the venture model. Two implications matter for LPs: 1) AI sharpens manager edge by broadening sourcing, compressing diligence cycles, and automating back-office overhead; and 2) AI lets companies do more with less – smaller teams, lower burn, faster iteration – thereby reducing capital needs and dilution while preserving ownership and exit optionality.

Finally, we remain skeptical of traditional funds-of-funds that add a fee layer while limiting LP look-through to managers and portfolio companies. We recommend investing directly with managers, or backing newer structures that centralize operations, preserve a single fee stack, and provide transparent, direct access to top investors and their ecosystems. We have a number of each that we can recommend.

Bottom line: With companies staying private longer and DPI down, venture remains a top-decile game. Allocate to smaller funds. Cap fees to a single stack. Require look-through and co-invest rights. Everything else dilutes the edge you’re paying for.

Digital Assets

Beyond AI, which is likely to have a growing and pervasive effect across the economy in time, digital assets represent a truly new asset class. Like private equity, we suspect some of the “best and worst” will be found in the new opportunities and prospective investors need to be clear about the particulars.

First, we see digital assets as an enabler and disruptor for the current financial system. Stable coins, for example, could speed payments in a way that disintermediates traditional banks. However, like money funds in the 2000s, there will be a time when stablecoins are tested as a risk asset under duress. With a stable price, they are not a return vehicle when they work as intended.

At the opposite side of the spectrum, bitcoin was developed as an alternative monetary system. Some portion of its gains in price have come from the shrinking value of central bank fiat money. It has succeeded thus far to be a store of value. With a limited quantity, it has been a strong return vehicle for 16 years. But what is the true driver of this return? Adoption from new buyers.

Like fiat money, bitcoin has no assets backing its value and produces nothing. The supply of bitcoins is limited. Demand from holders can vary. Bitcoin has limited capacity to drive technological change. Other coins and tokens linked to software and commerce - such as ether - are different. Yet these may not be capped in supply and also have no guarantee of future adoption.

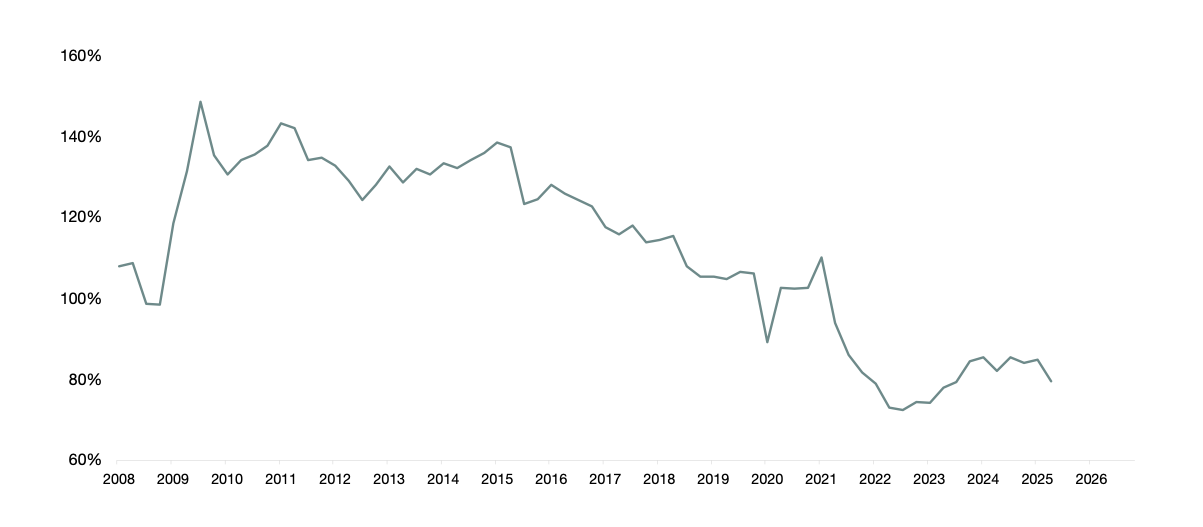

With this said, we can see the value of a speculative position in bitcoin. This is because fiat money itself has barely more than a five-decade history. As noted above, the US dollar remains more than 14% above its inflation-adjusted historical average value vs other fiat currencies.

With only 200 million bitcoin holders in the world, bitcoin could provide a high beta inversely correlated return for the US dollar. Since 2013, bitcoin has risen an average of 0.45% per day when the US dollar has fallen. Bitcoin has fallen 0.07% on average when the US dollar has risen.

As adoption increases, bitcoin returns should moderate. Volatility is severe. It will at some point have a peak in adoption and a fall in price. With little precedent, we would still see this as relatively far off in the future.

3 STEPS TO ACTIVE ASSET ALLOCATION

We believe investors need to understand the true sources of economic growth. Breakthroughs in technology and improvements in the organization of resources have solely driven increased per-capita living standards since the Stone Age.

PORTFOLIO OBSERVATIONS ENTERING 2026

SUMMARY OF OUR US ECONOMIC OUTLOOK FOR 2026

The Outlook for 2026 & Beyond

Contact the team at The CIO Group