The 3 Steps to Active Asset Allocation

STEP 1 - A LONG-TERM STRATEGIC FRAMEWORK

We believe investors need to understand the true sources of economic growth. Breakthroughs in technology and improvements in the organization of resources have solely driven increased per-capita living standards since the Stone Age. Disruptive technological changes for industry and labor have always been felt during this march of progress. Demographic forces - a rise in working population - drive the balance of growth overall.

We believe investors need to understand the true sources of economic growth. Breakthroughs in technology and improvements in the organization of resources have solely driven increased per-capita living standards since the Stone Age. Disruptive technological changes for industry and labor have always been felt during this march of progress. Demographic forces - a rise in working population - drive the balance of growth overall.

Investing in technological development - owning the productive capital of growing economy - drives wealth.

How we view the challenges of the year or more ahead, how we might defend portfolios from risk, doesn’t make us want to shrink away from investing for the future. It’s required for growing and preserving wealth for the long-term. The prospect that AI and other incipient technologies will drive disruptive change in the economy and financial system - allowing entirely new firms to build scale at the expense of those who fall behind - is a founding motivation of CIO Group. It is a force that will also drive investor returns.

BALANCING RISK AND REWARD

The choice to risk one’s capital and enjoy the returns driven by technological change drives vastly different returns for equities, bonds and cash. Figure 1 shows average inflation-adjusted returns of the past (near) century when an initial dollar invested is compounded over a decade for various cash weightings vs funds deployed in equities and bonds.

As we discuss below (“Step 2, Active Tactical Asset Allocation”) we don’t simply extrapolate this past into the future when setting our return expectations. Yet we believe the basic message from a century of data isn’t to be ignored.

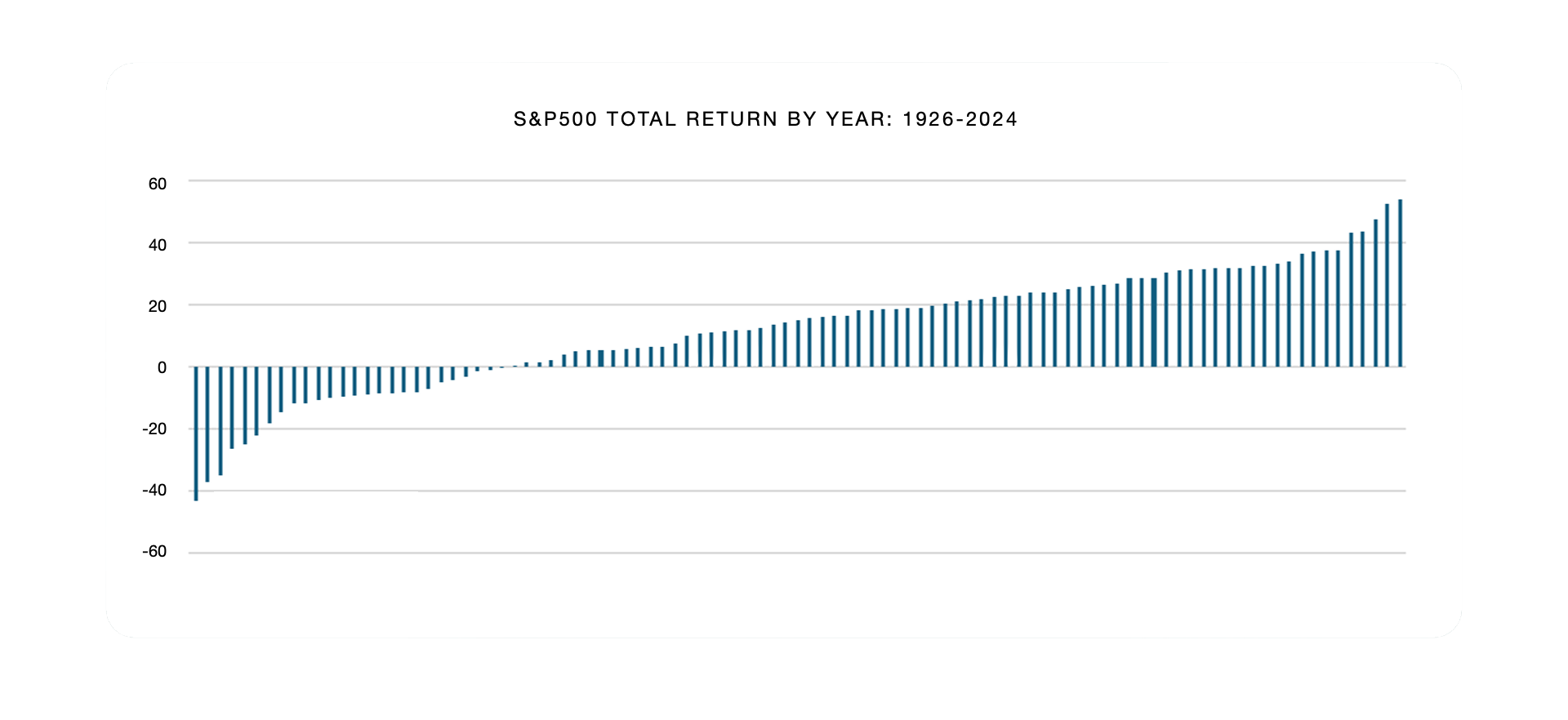

The distribution of annual returns for US equities during the past 100 years - including the tragic policy mistakes of the 1930s depression - gives much reason for optimism for positive returns on risk capital. Assuming unrewarding returns - even from today’s valuation - is betting against the odds (see figure 2).

Looking ahead, we believe investors need to be prepared for bouts of shocking volatility in asset prices and temporary losses in liquidity - an inability to exit positions even in sound assets at will. These shocks are temporary. For investors who aim to build wealth, it is not a reason to avoid risk assets in portfolios. Doing so would eliminate most of the potential to grow wealth.

Step 2 - Active Tactical Asset Allocation

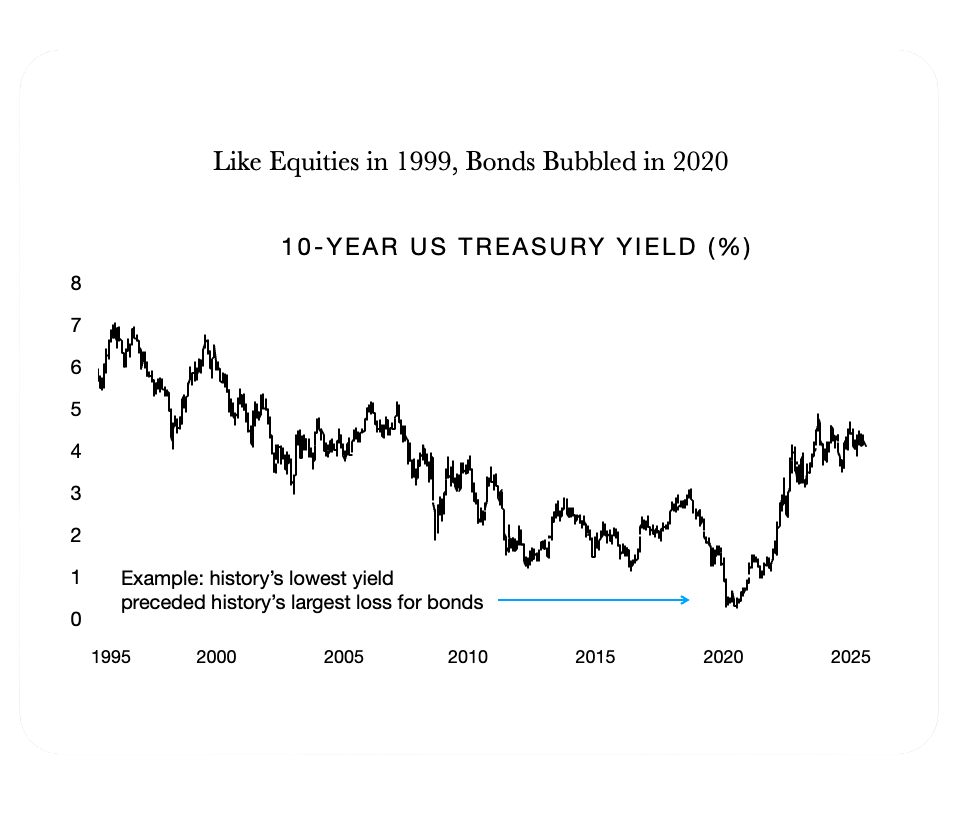

The largest annual decline for US equities in the past century was -43.3% in 1931. The largest decline in long-term government bonds was -17.0% in 2022. History’s lowest bond yields in 2020-2021 set the stage for a “Great Reset” in interest rates. Even so, the largest loss for a 60/40 mix of US bonds and stocks was -27.3% in 1931, a sharp improvement over investing in equities alone.

The largest annual decline for US equities in the past century was -43.3% in 1931. The largest decline in long-term government bonds was -17.0% in 2022.

History’s lowest bond yields in 2020-2021 set the stage for a “Great Reset” in interest rates. Even so, the largest loss for a 60/40 mix of US bonds and stocks was -27.3% in 1931, a sharp improvement over investing in equities alone.

Despite the imperative to expose long-term portfolios to equity risk, a combination of risky growth assets and income-producing secure assets has resulted in a higher risk-adjusted return over time. (I.e. return per unit of volatility). Over the past 80 years, a mix of global equities, bonds and cash has generated a risk adjusted return that is 13% above US equities alone1. This is despite US equities generating an inflation-adjusted long-term return that is 4.7 percentage points above the rate of bonds alone and 6.1 points above cash.

Diversification reduces risks but also reduces returns at different times. Therefore, to determine risk tolerance, investors need to ask themselves two questions to balance: What is my long-term return target and what sort of annual loss could I tolerate? At CIO Group, we aim to provide a realistic estimate of both for investors.

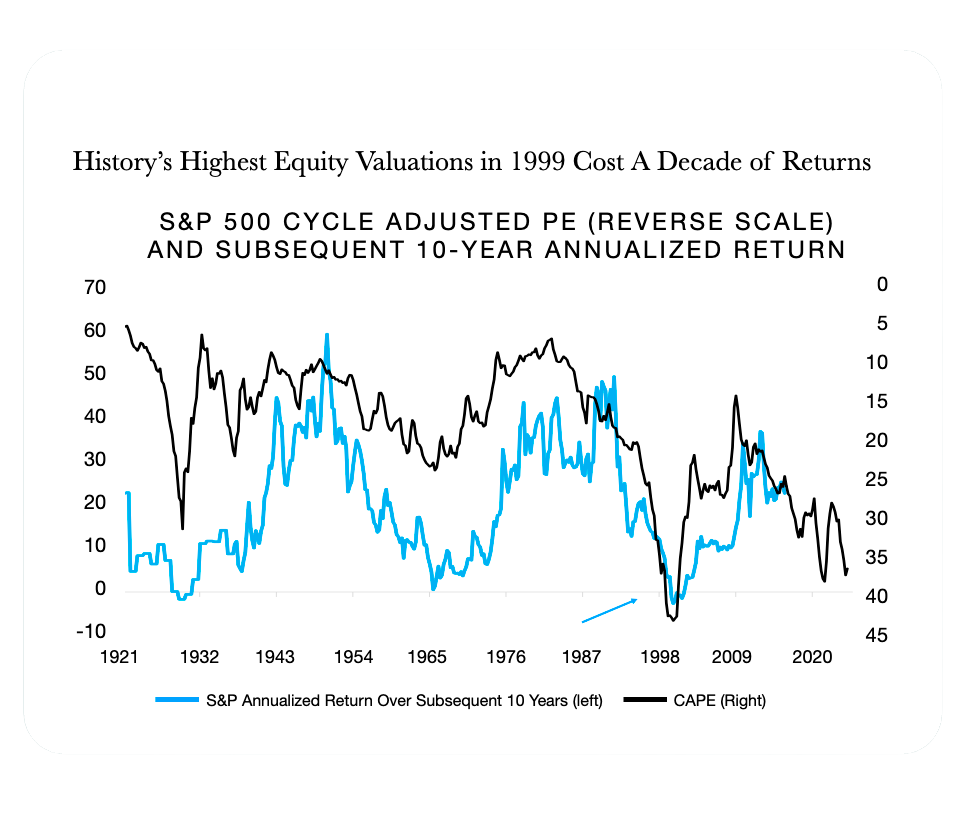

Our risk/return assessment depends importantly on today’s valuation.

As figures 3-4 show, one shouldn’t invest with a static “60/40” allocation when assets aren’t valued in a way that can meet return expectations. The 0.5% US Treasury 10-year yield in 2021 was incapable of delivering historic safety and yield. This led to the market bust of 2022.

Similarly, history’s highest equity valuations in 1999 and a profit bust drove deep losses for US and global shares in 2000-2002. Yet, despite losses of similar scope again in 2008, history prevailed and US equities led world asset markets to record returns in the years that followed.

We believe that investors who fail to take advantage of market busts make a portfolio mistake often more damaging than “investing at a top.

So, what are today’s valuations telling us about the proper mix of equities and bonds, other asset classes?

Yields on safer government bonds and credit (including private credit) are now earning a “full” historic allocation. Their risk-adjusted returns appear historically solid for today’s investor. With consideration for our economic outlook, this full fixed income allocation leaves us neutral on equities at the moment. However, active tactical asset allocation can still do much more to drive returns.

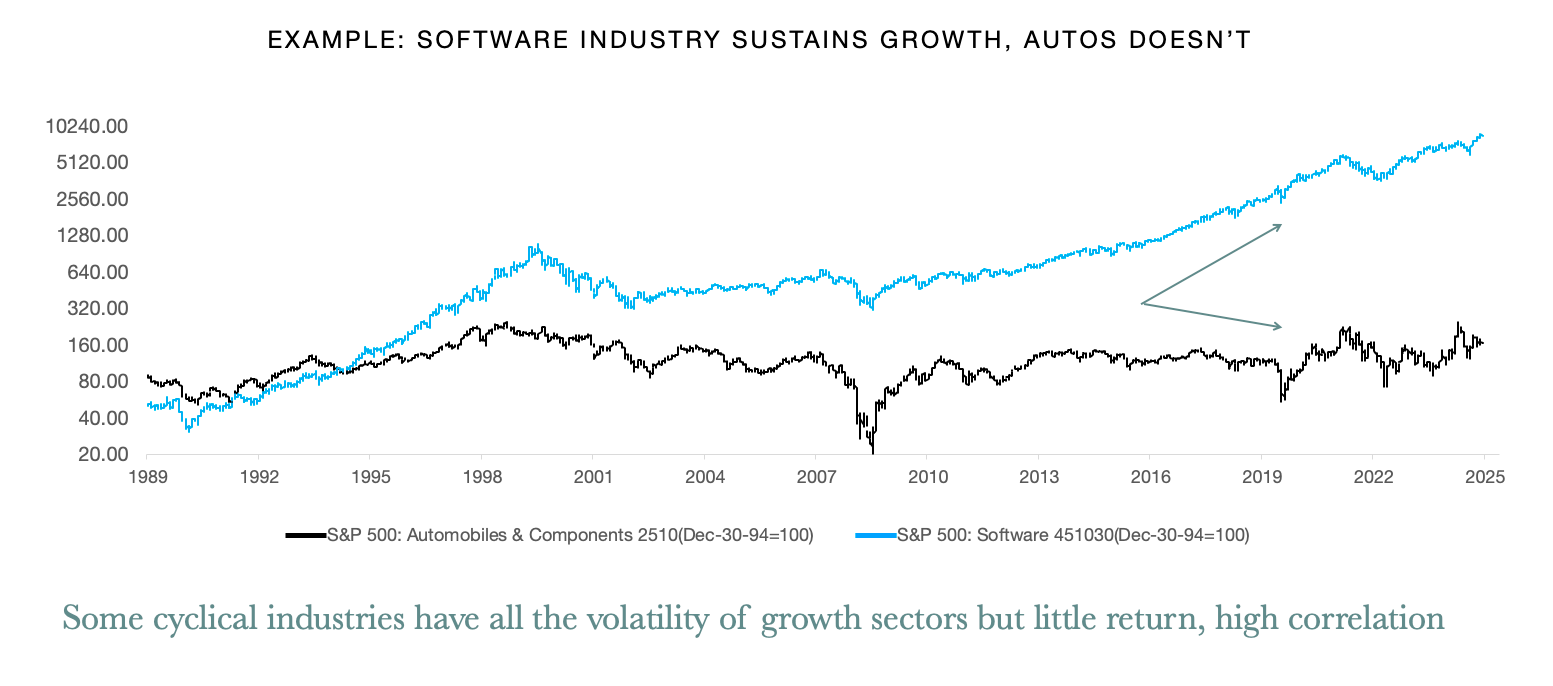

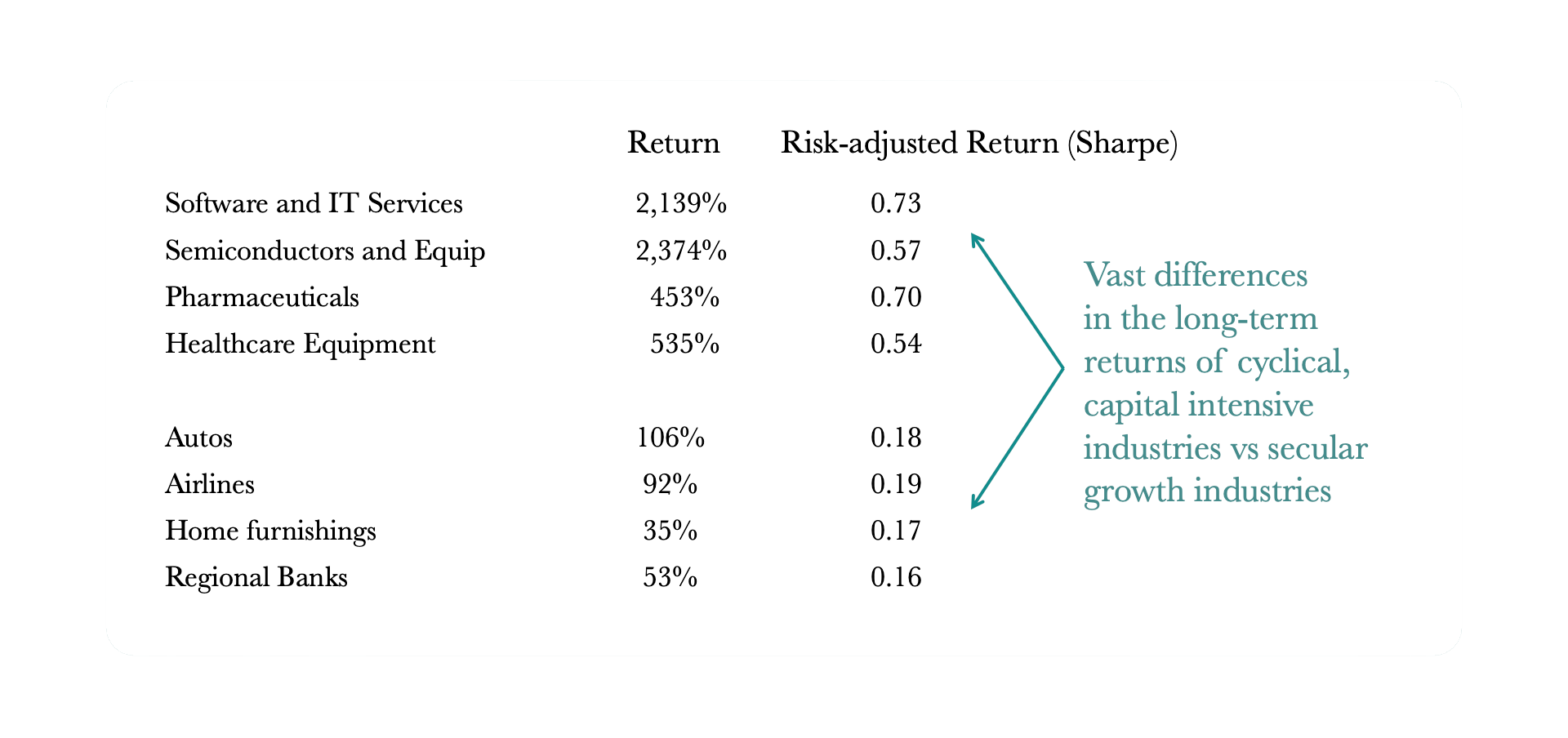

Particular equities have a wide range of risks. Yet as figures 5-6 show, many display high volatility, but very different ultimate returns. As an example, the software industry and autos both fell sharply in 2022 , with autos falling more (-40% and -68% respectively). Were investors rewarded for the volatility of autos? No. Over the past two decades, the cumulate total return for software has been 2,139% and autos 106%.

Investors in software generated much stronger sustained returns while suffering less risk than investors in the autos industry. There are many similar, but less obvious examples. (See Figure 6)

Some cyclical industries have all the volatility of growth sectors but little return, high correlation

Which industries will grow changes over time. The internal combustion engine was once a novel new technology. Today’s best software code and the chips that execute software commands face constant threat of obsolescence. But this technology is also an evolutionary process, compounding returns for an active portfolio of companies, both public and private, as ever better products are developed. Some tech incumbents have strong “inertia” and scale advantages to ward off competition as they innovate. Some will face disruption.

At CIO Group, we build equity portfolios that seek sustained growth while accepting risk. We offset risk by investing in bonds that can truly absorb market weakness while providing solid income. With large allocations to forever stagnant industries, equity market benchmarks don’t exploit this opportunity. Including some very poorly yielding or risky credits, global bond benchmarks don’t either.

Opportunistically, we can hedge portfolio risks directly with derivatives. We can hedge or earn historically high incomes in periods when other investors are unusually complacent or panicked. Commodities including gold can play a supporting role.

Step 3 - When it Comes to Cash Management, Most Investors Can Do Better

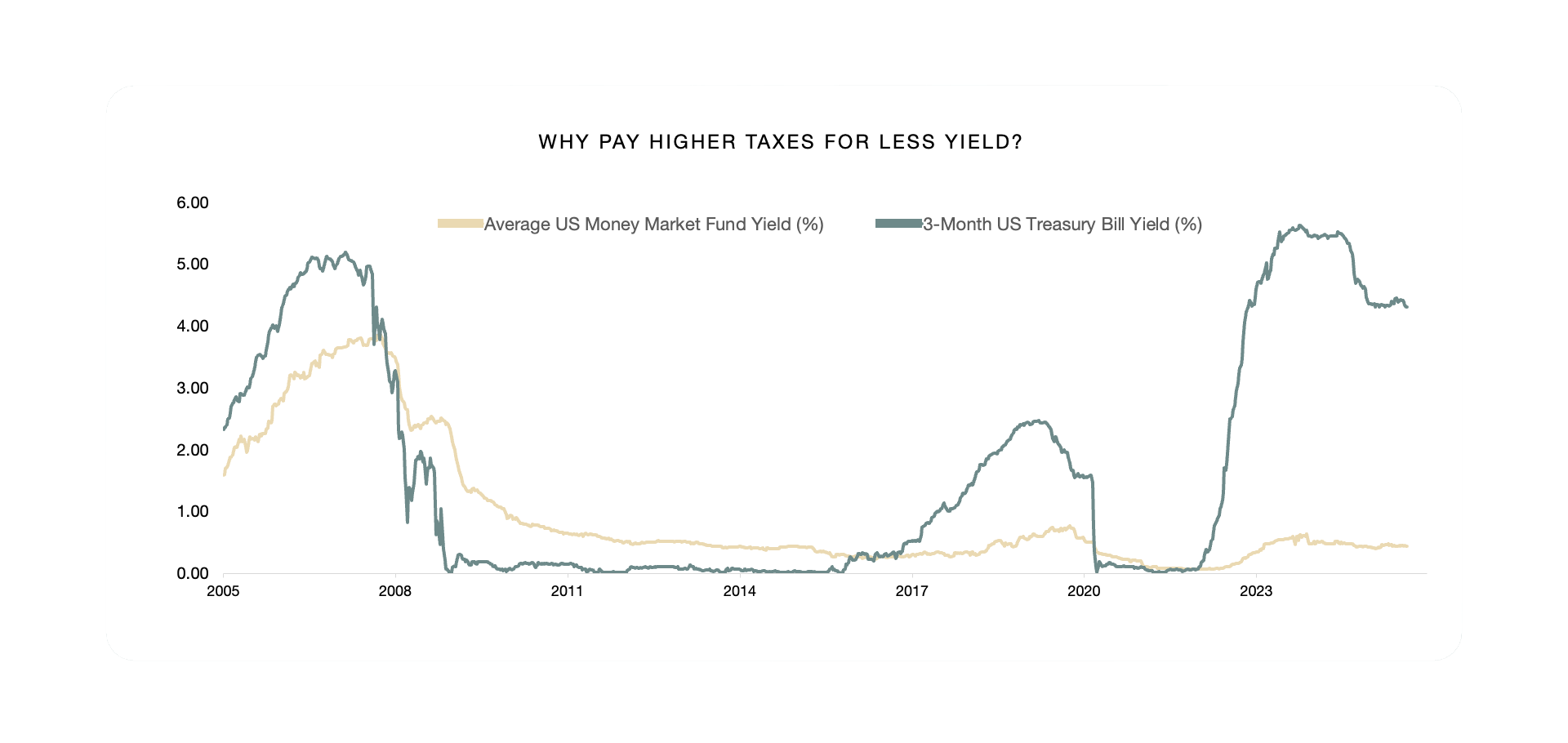

Investors generally fail to optimize cash in their portfolios and it costs them. Today, 25% of US bank deposits - over $3 trillion in the capital of savers - offers a zero yield. When savers do find better yields, their deposits are often taxed at higher rates than available options yielding more (see figure 7). Observing portfolios of wealthy investors, we believe that better cash management alone can drive 175 basis points in higher average returns.

Over a decade, this would add $242,000 for each $1 million in cash held.

What is Your Advisor Telling You About Performance?

At CIO Group, we respect the value of benchmarks for measuring the value we aim to create. Failure to observe benchmarks often excuses poor performance and poor risk management.

Market benchmarks with long histories allow us to measure and forecast risk and return with some degree of certainty. In contrast, new innovations such as cryptocurrencies have an unknown range of risk and return (including complete loss of principal). This does not mean we should avoid a position, but it should be scaled for a speculative range of outcomes.

Most of the time, we would expect to identify 10-20% of a portfolio to diverge from market benchmarks. This may be higher or lower depending on the opportunities markets afford. Tactical overweights can include innovations in a range of speculative new technologies or assets, but not at a scale that risks might derail the overall portfolio.

We would expect the largest part of our “active” tactical positions that diverge from benchmarks to be industry equity allocations - such as cybersecurity or medical innovation as examples. In the bond market, we can see a wide range of yield opportunities globally that suggest off-benchmark positions to enhance returns.

PORTFOLIO OBSERVATIONS ENTERING 2026

Based on our direct observations of how family office and UHNW investors are positioned coming into 2026, we have found several notable observations...

DEEP DIVE INTO ALTS, VC & DIGITAL ASSETS

SUMMARY OF OUR US ECONOMIC OUTLOOK FOR 2026

The Outlook for 2026 & Beyond

Contact the team at The CIO Group