The Outlook for 2026 and Beyond

The year behind us saw a predictable rise in global market volatility on the vastly changing macro policies of the new US administration. April saw a near 20% correction in US equities. In 2023, a correction was near 10% before full recovery. No economic collapse took place in either case.

The economic costs of US tariffs, retaliation and business uncertainty have been less than feared at the peak of concern in April. Then, it appeared that effective US tariffs would rise 10-fold. At such a level, the domestic tariff collection alone would have presented the largest tax increase as a share of US GDP since World War II. Actual tariff collections since imposition point to a 4-fold rise this year, or 0.9% of US GDP, holding down growth and slightly boosting inflation.

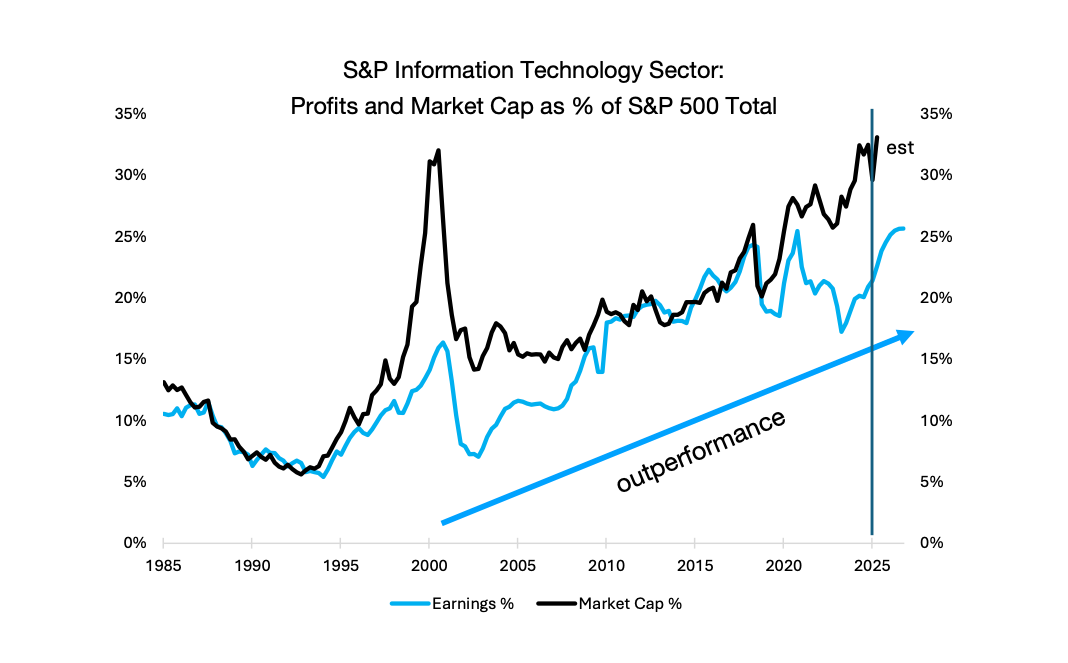

Future tariff uncertainty remains, and negative impacts from retaliation may still raise the impact. Even so, it appears that US economic growth will be near 2.0% in 2025 given its weak start. This is somewhat above Federal Reserve estimates. On the negative side, corporate earnings have been highly concentrated in AI-linked technology firms and supporting industries. Barring new shocks, some firming and broadening in profit gains should manifest in 2026.

We believe the larger effects of the US tariffs, immigration restraints and international discord will play out within 2025, leaving just moderate constraint on 2026 as a whole. Tariffs do not need to be pulled lower for their negative effects to fade. With global macro policies turning modestly more growth friendly - including a resumption of Federal Reserve easing steps - we see a strengthening upward bias in the economic growth trajectory for 2026. This is driving strong global equity returns this year, with a positive carry over likely deep into the coming year.

US markets are one beneficiary. China, Europe and their trading partners are others. It will not be enough to banish growth fears and market volatility. Global growth is unlikely to rise sharply above trend until 2027 at minimum. Inflation should continue to fade following a ‘’tariff bump,” but with questions of whether the drop will be lasting or sufficient.

Long AI Capital, but Short US Dollar

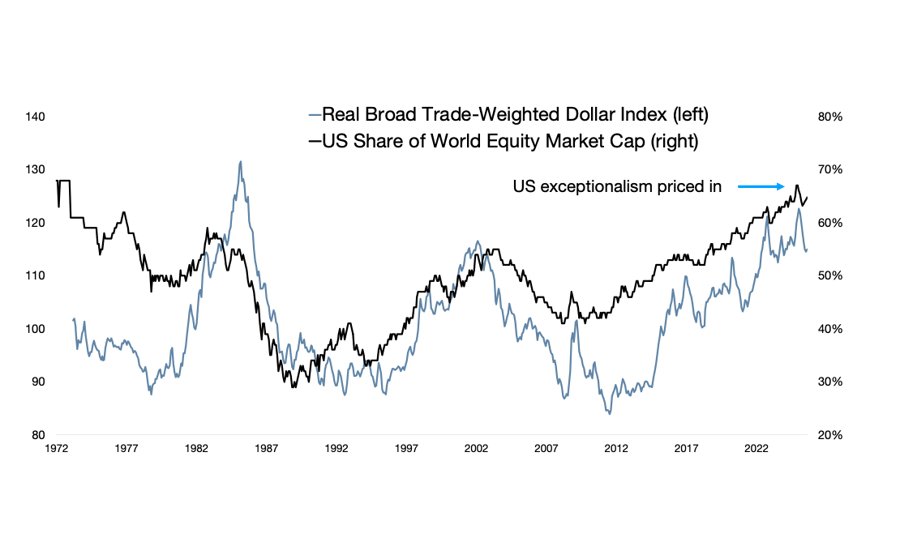

Among the largest questions for investors is the one of international diversification. Fast and unpredictable change in US policy under the Trump administration has left foreign investors less secure in their view of the US dollar. We see great risk and opportunity in how this will play out. As figure 8 shows, the US dollar today remains 14% above its long-term average value in inflation adjusted terms.

Prior to 2025, US equities outperformed global equities for a record 15 years, setting the stage for improved non-US returns this year. Yet the US is also driving the greatest commercial innovation in technology, particularly AI. We must balance these contrasting risks and opportunities (see figure 9-10). They are not mutually exclusive.

3 STEPS TO ACTIVE ASSET ALLOCATION

We believe investors need to understand the true sources of economic growth. Breakthroughs in technology and improvements in the organization of resources have solely driven increased per-capita living standards since the Stone Age.

DEEP DIVE INTO ALTS, VC & DIGITAL ASSETS

SUMMARY OF OUR US ECONOMIC OUTLOOK FOR 2026

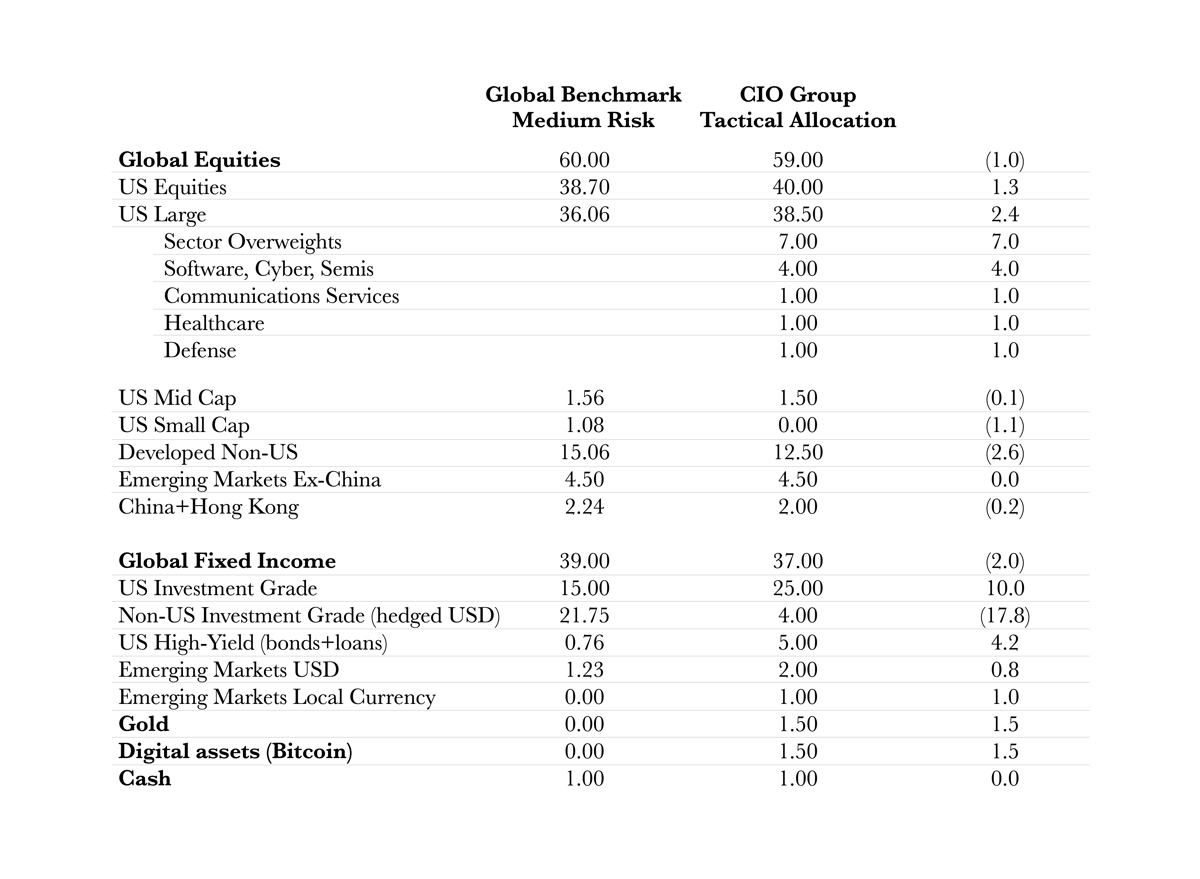

Portfolio Observations Entering 2026

Contact the team at The CIO Group