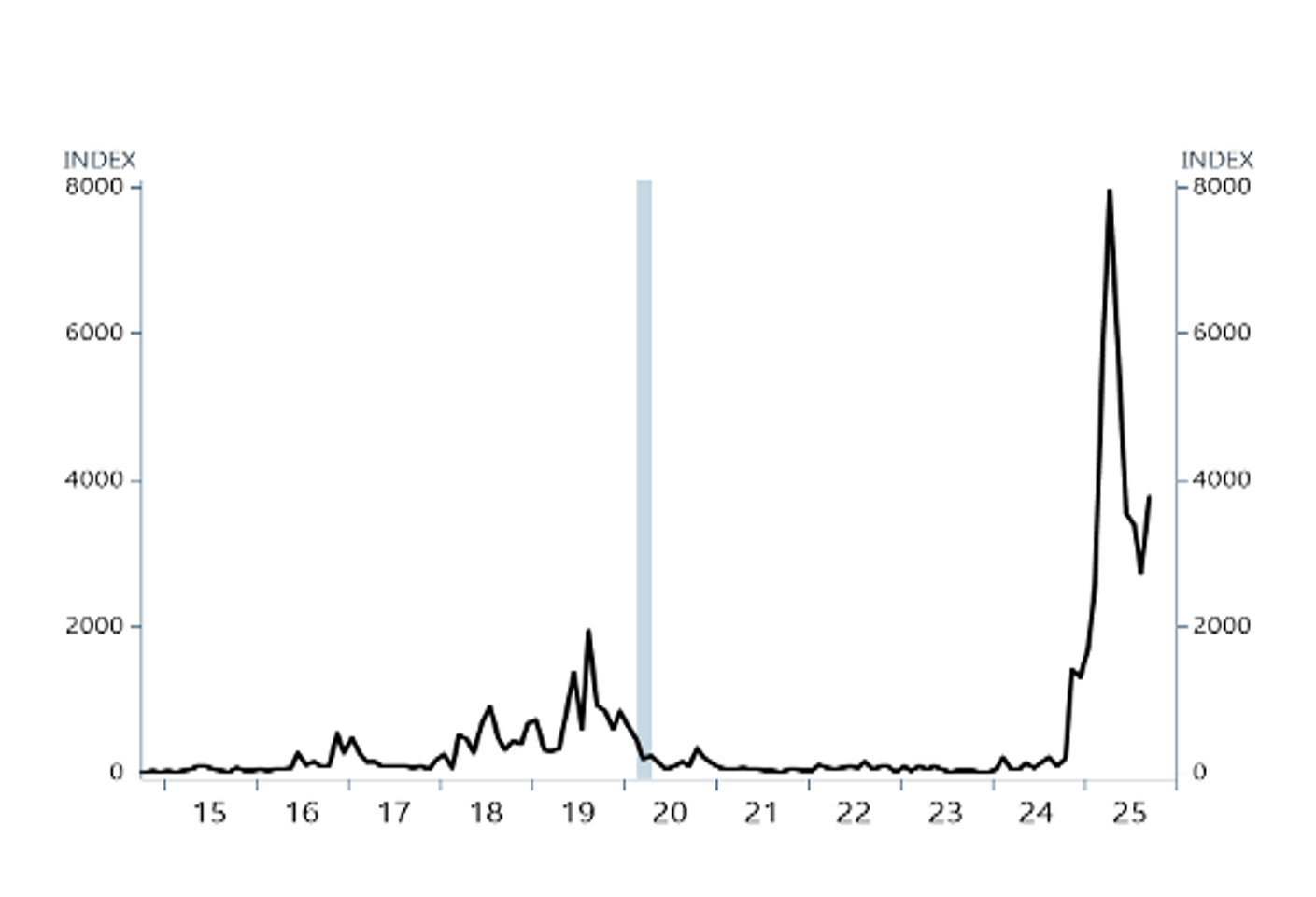

Will Market Speculation Cool As Détente With China Ends?

Friday’s selloff illustrates the vulnerability of global markets to recurring trade uncertainty (SEE FIGURE 1). President Trump said he is considering a 100% additional tariff on Chinese goods exports and other measures unless President Xi relaxes rare earth export restrictions. The technique of using large threats to influence near term negotiations has become standard procedure for the President and team.

We view restrictions on the export of critical supplies as a larger threat to economic output than the aggregate costs of tariffs. While tariffs are a tax on US consumers, supply chain disruptions have the potential to curtail production and shrink employment for impacted industries with attendant spillover effects. This is why we believe the present 100% tariff threat will lead to a negotiated settlement.

Since April, US tariff collections on Chinese goods have raised about $80 billion (annualized). The overall increase in all US tariffs is about $270 billion (0.9% of US GDP).

While this is a sizeable tax shared by consumer wallets and corporations, the collections are running 64% lower than estimates published in early April.

Friday’s market action, with the US dollar dropping and US shares falling nearly 3%, mirrors early April, 2025. We believed then, as we do now, that the economy is adaptive and resilient. After the scare last April, actual policies adjusted and shares recovered. With this said, we would expect some market complacency that has built up since mid August to unwind before a focus on positive 2026 earnings becomes the dominant narrative for US equities.

The Rally in Small Caps Overshadows the Better

Opportunity in Mid-Caps

Small caps surged 40%, but unprofitable firms led the rally. Why we're finding better value in profitable mid-caps at a 15% discount.