The Rally in Small Caps Overshadows the Better Opportunity in Mid-Caps

Prior to Friday’s drop, the small cap Russell 2000 had jumped 40% since the early April collapse on tariff concerns. This beat the 35% gain for US large caps. Looking more closely at that performance, we note that gains in small caps since August have also been skewed toward profitless firms, a cause for concerns as we build 2026 portfolios.

Academic research suggests higher returns for the small cap asset class, particularly after a decade of underperformance. Investors will be sure to note that the world’s most valuable companies were once mere startups.

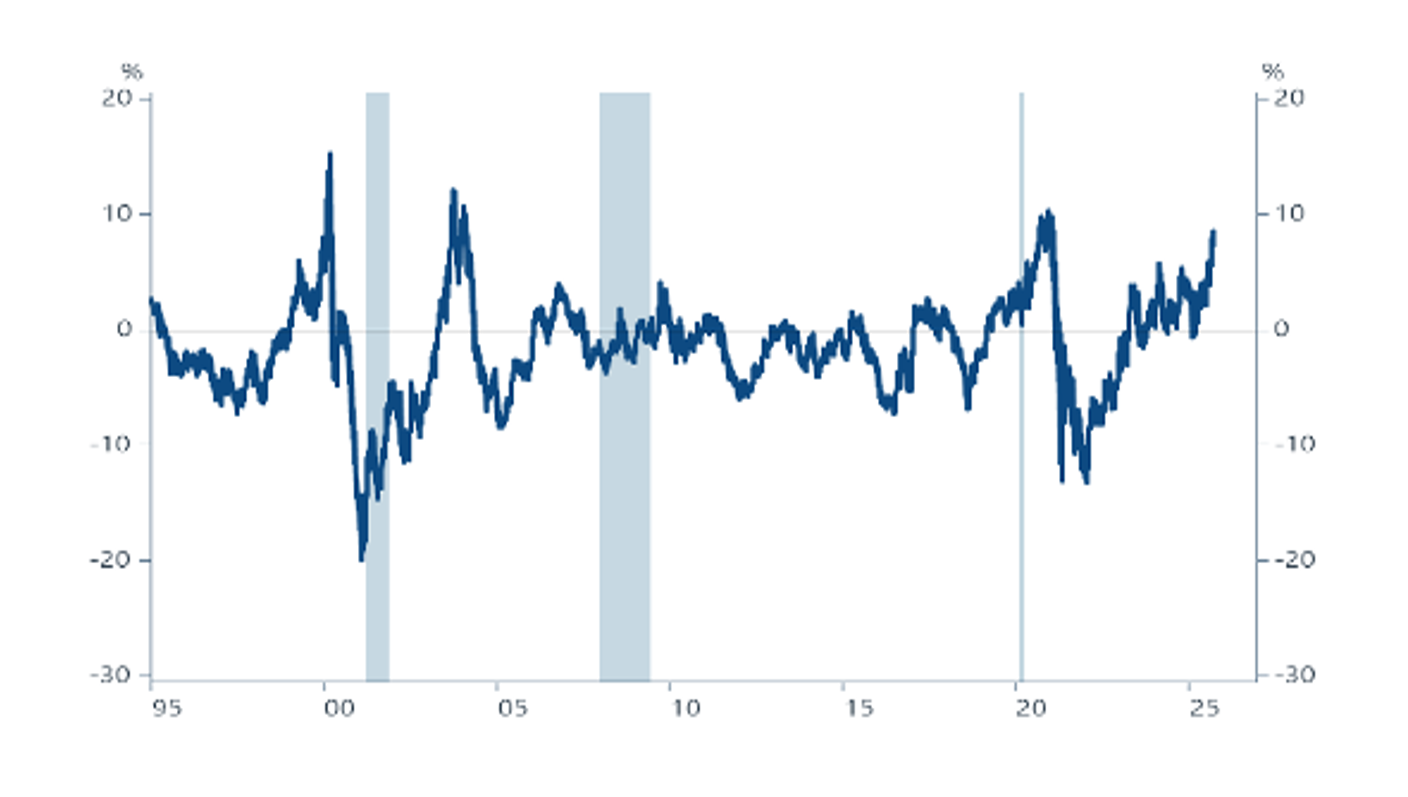

However, a more accurate “lens” to view the rebound in small caps is that recent gains reflect higher volatility of small caps. During the April 2025 swoon, the Russell 2000 dropped nearly 28% from its high vs 19% for the S&P 500. This drop and ensuing recovery created an appearance of outperformance, even as the annual returns of the S&P 500 have been more than double the Russell 2000’s over the last 10 years.

As Figure 2 shows, the Russell 2000 index, with roughly 40% of firms unprofitable, has outperformed the S&P 600 since late August. This illustrates a bit of a surge in speculation and risk tolerance. It is a sign of vulnerability for lower quality assets.

This came into play Friday, when markets resumed dormant trade fears.

At CIO Group, we would emphasize lower-quality small caps only after an economic contraction and large declines for the asset class. Since 1990, the Russell 2000 has beaten the S&P 500 in the 12 months following a recession by 16.7 percentage points on average. It beat the S&P 500 in all four such cases. Yet the Russell has only done so after suffering much larger losses prior to these gains.

Famously, professors Fama and French estimated higher structural returns for smaller firms than larger firms based on empirical data since 1927. The “size premia” makes theoretical sense. Large firms already dominating their industry have natural growth limitations. However, the data are strongly influenced by returns for smaller firms during the 1930s-1970s. Small cap returns gradually moderated since then. Of course, every industry-leading firm was once an upstart. Measuring returns for firms like Apple and Microsoft from their IPO days is an exercise in “data mining.” That’s why it is unwise to link such returns to a broad index of small caps such as the Russell 2000.

CIO Group is focused on profitable US mid-caps that trade 15% below the trailing valuation of profitable small caps. In fact, in our all-equity model portfolio, we retain an average allocation to small caps and include only those that are profitable. As forward-looking investors, both the earnings outlook and market sentiment for SMID performance get our attention. In order to achieve broader share price gains – beyond large cap Tech – SMID shares will experience the benefits of a brightening economy that the CIO Group anticipates in 2026.

Concentration Risks vs. Broadening Profits: An

Investors Conundrum

Three companies equal Asia's entire market. Concentration risk is real, but diversification opportunities exist—and we're not calling a market peak yet.