Concentration Risks vs. Broadening Profits: An Investors Conundrum

Just three American companies (NVDA, MSFT, AAPL) are worth $12.3 trillion, representing 18% of US indices. This is roughly equal to the market cap of all the publicly traded firms in either Asia or Europe.

That’s why prudent investors should have reasonable concerns about concentration risk in their portfolios.

Chipmakers have a long history of cyclical swings and obsolescence. And Apple – today’s consumer tech giant - has had two declines of about 85% within the past four decades. One of the market's hidden risks is a “near miss” in earnings or projected revenues by any of these three leaders. Another such risk would be unbridled bullishness. For the moment, bullish sentiment is roughly equal to bearish readings in investor polls. This is unlike the late 1990s when bullish investors could not imagine anything going wrong. Today, we are routinely confronted with concerns about the AI bubble and excessive AI investment spending. Bear markets that correct for high equity returns are driven by fundamental catalysts, particularly falling profits. We don’t see this in the coming year.

Concentration risk is real, regardless of whether you are a bull or bear. Professional investors and speculators lagging index performance have purchased far more call options than puts, a sign of “performance chasing” in 2025. Prior to Friday’s selloff, implied volatility was low (the VIX jumped from 16-22).

At CIO Group, we also have concerns about how highly correlated the largest tech names might be to an increasing share of US industry. Yet an “everything rally” is also a sign of elevated risk.

These observations provide difficult questions to answer without the benefit of hindsight. To date, however, we are not convinced that speculative excesses suggest a lasting peak in markets or the economy.

A “broadening” of equity market performance to include many smaller shares, industry sectors and regions of the world can be good news if their profits rise accordingly.

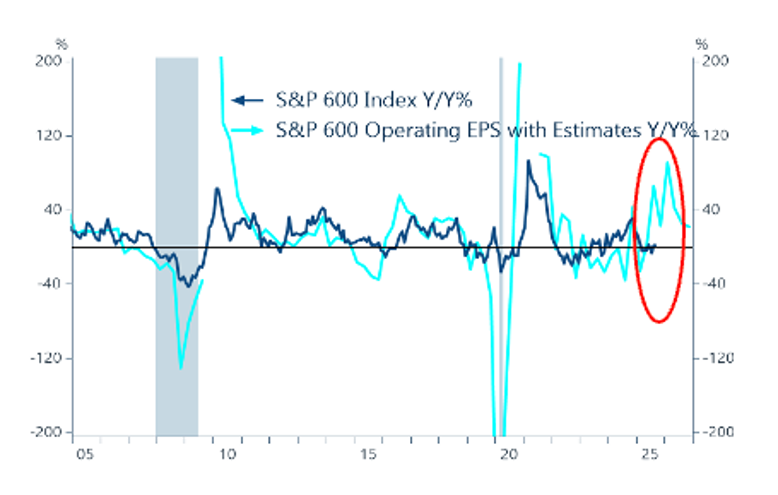

This is why we are seeking areas of the market, like profitable mid caps, where we can find growth at a reasonable price. We also look toward these shares as a source of diversification. We expect that corporate profits to have remained resilient and broadened in the quarter past, beyond the usual “low ball estimates” typical for 3Qs. The estimates for smaller companies in the US look particularly robust (see figure 3).

Consensus estimates for the S&P 600 – an index whose constituents require profitability tests – shows a 106% gain for the final quarter of 2025. While this is still a tad below a record high in profits and is ultimately achievable, it seems premature to assume it will be given the recent macroeconomic headwinds.

Will Market Speculation Cool As Détente With China Ends?

Markets plunged on Trump's tariff threat, but actual collections fell 64%. Why supply chain disruptions matter more than tariffs themselves.