2026 Expectations and Portfolio Design

CIO Group’s Outlook for 2026 highlights meaningful EPS growth across the US economy. With tariff uncertainty fading, the manufacturing and construction sectors are likely to see an uptick in production. The AI infrastructure boom of 2024-25 will continue at a slower pace (15%-25% YoY). Global growth is likely to be about 3% with broader growth in non-AI industries and lower energy prices providing catalysts. In short, we do not see a period of negative GDP or EPS immediately ahead of us.

News that some small auto parts and auto finance companies and their creditors suffered fraud and credit losses sent US regional bank shares down 10% over the past month. Yet, it is a great leap to assume that consumer stress in auto finance is the “leading edge” of a soon-to-be realized collapse in credit markets.

That said, investment portfolios must reflect changing economic realities. CIO Group portfolio exposures in the later stage of economic expansion are designed to avoid the areas most likely to see stress first. These include regional banks and automobile-related lending. They also must lean into areas of sustainable growth and increase diversification to mitigate future risks.

At CIO Group, we believe balanced portfolios should stay exposed to growth at a reasonable price. Deep into a bull market such as this one, quality assets should be emphasized, with a focus on balance sheets as well as growth opportunity. Volatility often picks up as expansions mature. Therefore, one needs an offset in uncorrelated assets. Examples include healthcare shares, Asian tech, US Treasuries and municipal bonds.

Today, the bond market offers valuable diversification with a yield solidly above inflation. In equities, value is found in industries such as healthcare that have not participated in the tech boom. As the Fed eases, non-US growth equities are also likely to contribute more to returns.

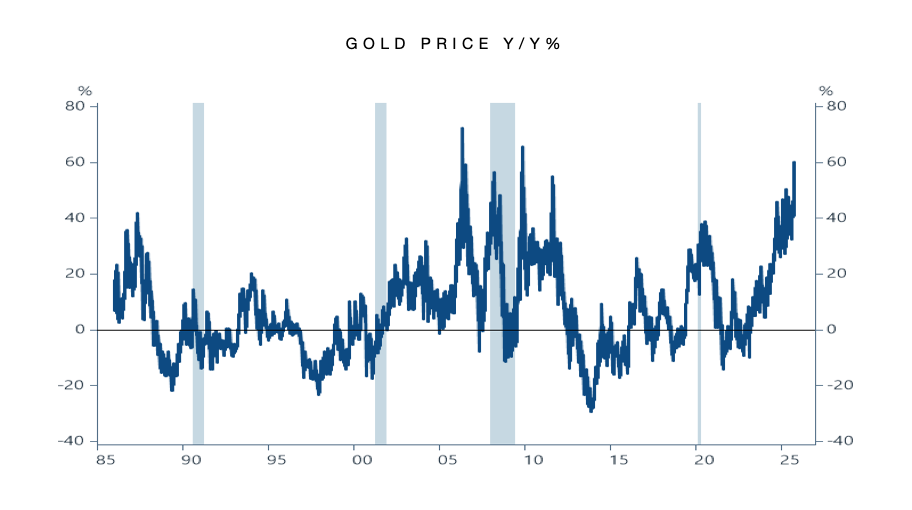

Another element of CIO Group’s Active Asset Allocation is building tomorrow’s portfolios based on future return estimates rather than yesterday’s performance. While gold is a small tactical holding in our portfolios, its 48% gain over the past year suggests it will not be a useful hedge for generalized risk aversion in the near term (see Figure 1). While we continue to hold it at a constrained weight, we also hold a 1.5% weight for Bitcoin in our medium risk portfolios as it is less mature in adoption as a store of value.

UNPRECEDENTED TIME, EXCEPTIONAL PORTFOLIOS

CIO Group believes recent regional bank selloffs overreact to isolated credit losses—not a systemic collapse. Our Outlook 2026 sees potential for earnings growth ahead. We explore why quality, diversification, and forward-looking positioning matter now more than chasing past performance.

Contact the team at The CIO Group

IS AI LIKELY TO LEAD TO A REPEAT OF 1999?

NO BANKING CRISIS – QUITE THE OPPOSITE NOW

WHAT TO WORRY ABOUT