No Banking Crisis – Quite the Opposite Now

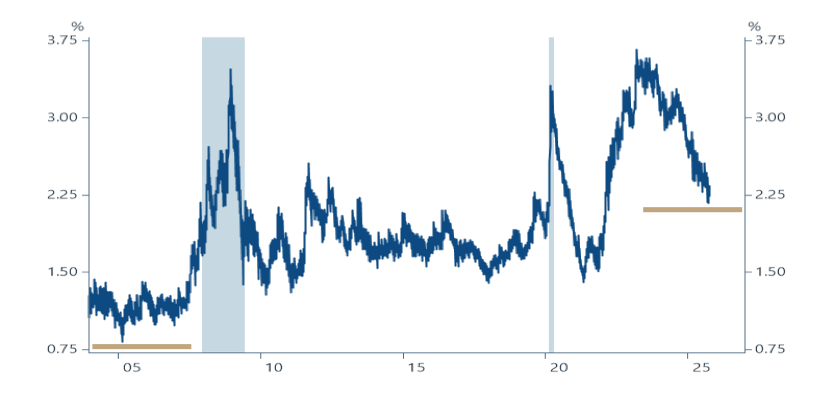

With the Fed easing and the yield curve steepening, bank profits are surging. With deregulation promised, mortgage spreads are now falling, signaling a wider availability for US home lending ahead (see Figure 3).

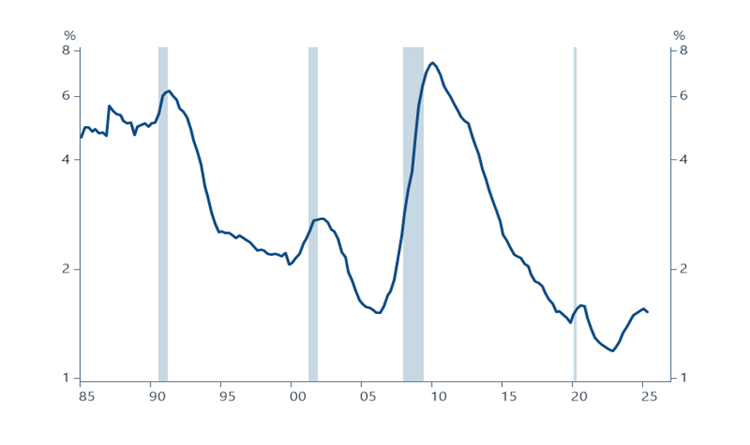

The Fed's lending officer survey shows banks are gradually easing standards across the board - though they're starting from pretty tight levels. Credit delinquencies across all forms of loans have picked up modestly (see Figure 4), but remain historically mild.

In some future period of meaningful US job losses, auto lenders will suffer from non-performance. Yet, it is a great leap to assume the latest news on the fringe of auto finance is the “leading edge” of a soon-to-be realized collapse in credit markets that would threaten the US economic expansion.

UNPRECEDENTED TIME, EXCEPTIONAL PORTFOLIOS

CIO Group believes recent regional bank selloffs overreact to isolated credit losses—not a systemic collapse. Our Outlook 2026 sees potential for earnings growth ahead. We explore why quality, diversification, and forward-looking positioning matter now more than chasing past performance.

2026 EXPECTATIONS AND PORTFOLIO DESIGN

IS AI LIKELY TO LEAD TO A REPEAT OF 1999?

Contact the team at The CIO Group

WHAT TO WORRY ABOUT