Is AI Likely to Lead to a Repeat of 1999?

When you watch tv pundits, talk of the Great Depression, 2008, and the 1999 tech crash are often cited. But, let’s look back at what really caused the 1999 tech bubble to burst.

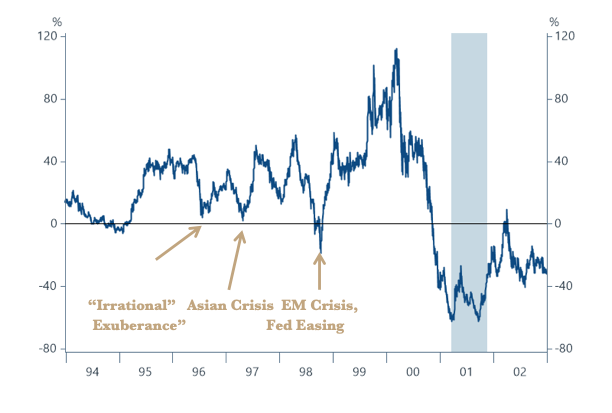

After a 34% surge for the S&P 500 in 1995 and another 20% in 1996, then Fed Chair Greenspan warned of “irrational exuberance” in equity markets. Equities corrected 10% by early 1997 before recovering in second half of the year. The Fed subsequently maintained a tight monetary policy and a currency crisis in Asia ensued, spreading across the emerging world. This led to a 20% decline in US shares in Autumn of 1998. In reaction, the Fed quickly reduced policy rates by 75 basis points in three steps to support the US economy.

With that backdrop, optimism associated with the internet-driven “new economy” helped equities rise 27% in 1998 and nearly 20% in 1999. The Nasdaq composite surged 86% (see Figure 2). By early 2000, large cap information technology shares traded at 66X trailing earnings.

Tech valuations and earnings both peaked at the same time. Operating profits fell 57% in 2001. With accounting scandals related to equity compensation arising in parallel, the Nasdaq composite dropped as much as 78% from its 2000 peak. Many unprofitable firms failed. Excessive and quickly obsolete investments drove a capital-spending led recession. Though US corporate earnings fell modestly, losses for tech shares were profound. Today, prior industry leaders such as Cisco Systems remain below their peak valuations.

UNPRECEDENTED TIME, EXCEPTIONAL PORTFOLIOS

CIO Group believes recent regional bank selloffs overreact to isolated credit losses—not a systemic collapse. Our Outlook 2026 sees potential for earnings growth ahead. We explore why quality, diversification, and forward-looking positioning matter now more than chasing past performance.

2026 EXPECTATIONS AND PORTFOLIO DESIGN

Contact the team at The CIO Group

NO BANKING CRISIS – QUITE THE OPPOSITE NOW

WHAT TO WORRY ABOUT